It’s an exciting time for the healthcare staffing industry, as demand for its services is greater than ever. Since implementation of the Affordable Care Act, which raised the number of Americans with insurance by more than 20 million, healthcare providers have been reporting increasing patient volumes. Since the health insurance exchanges and Medicaid expansion associated with ACA began in 2014, admissions began to climb. Even if growth flattens out, admissions will remain at these elevated levels, and it will take time for supply to catch up.

The rise in admissions has been primarily reflected in outpatient trends as healthcare providers have been vigilant in using this setting to more efficiently accommodate increased patient demand. Staffing firms are reporting that outpatient — though still generally a minority of their business — has been a growing piece of their customer portfolios.

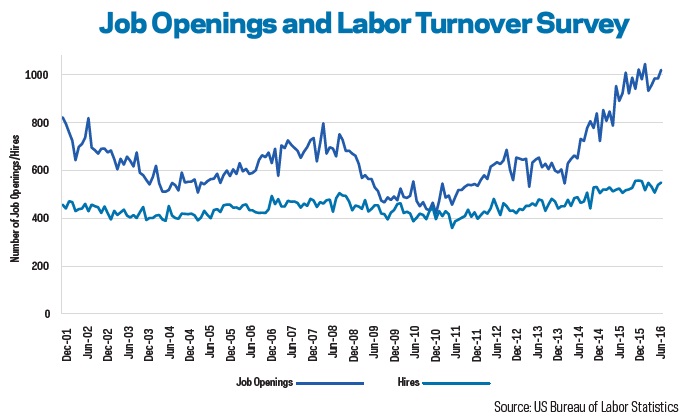

Nevertheless, patient volumes have been rising, creating demand for workers to accommodate the influx. In the past two years, the number of job openings for “healthcare and social assistance” workers has surged well past pre-recession levels of 2007. Moreover, while the number of hires has increased as well, it has not kept pace with job openings, suggesting a struggle to find workers. Given the educational requirements for many healthcare jobs, it will take time for supply to catch up to demand, and healthcare providers are depending on staffing companies to address their pressing workforce needs.

Given the current environment, it is not surprising that Staffing Industry Analysts projects US healthcare staffing market revenue to grow by double digits for a second consecutive year in 2016. Even though growth appears to be moderating moving into 2017, even low growth at these levels means record levels of business for healthcare staffing. The market is full of opportunity for anyone who can recruit.

Long-Term Environment

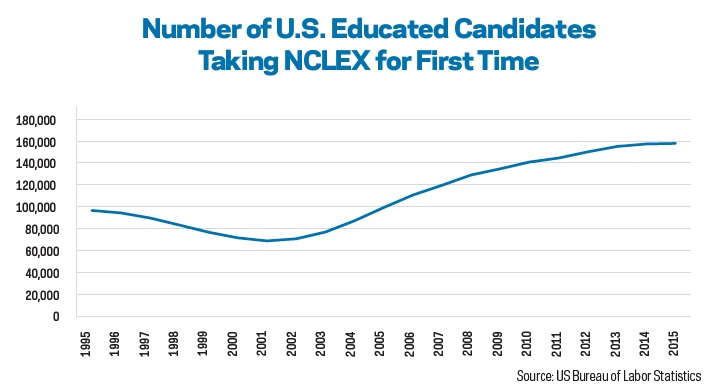

The long-term picture, however, is more complicated. Given enough time, supply should be able to catch up to demand. Since 2001, the number of US-educated RN candidates taking the NCLEX (nursing licensure) exam for the first time has risen dramatically. While we have been hearing about projections of catastrophic nursing shortages for some time, many of these alarming articles were based on old workforce projections that were based on the number of NCLEX graduates in 2000. However, in 2014, the US Department of Health and Human Services (HHS) updated its supply and demand projections, forecasting no shortage of RNs at the national level in 2025. In fact, there was a projected excess supply of 340,000.

While the government projection is only one data point, the main takeaway is that long-term projections of workforce shortages are seldom a forecast of what will happen, but rather what would happen if action is not taken — and usually action is taken. For example, in response to projections of severe nursing shortages, public outreach drew more people to the profession and nursing schools increased enrollment. As illustrated in the graph, twice as many US-educated RN candidates took the the NCLEX for the first time in 2015 when compared with 2001.

There are also major structural issues taking place in the healthcare industry. The most visible change is the shift from volume- to value-based payment, in which providers are paid based on the health of the patient and quality of care rather than the quantity of service provided. HHS last March announced that it has achieved its goal of tying 30% of traditional, fee-for-service Medicare payments to quality or value through alternative payment models such as accountable care organizations or bundled payment arrangements. The goal of tying 50% of Medicare payments to such models by 2018 appears reachable as well.

In a landscape in which hospitals are less incented for volume, this could mean less overall demand for workers, especially over time as the supply of graduates catches up to the demand. What hospitals will need more from staffing companies is quality. While quality is certainly important now, in a value-based environment, healthcare providers are incented to pay more for better workers, as they are less likely to get paid to fix their mistakes. If there are complications from a treatment because a nurse makes a mistake, and that patient has to stay longer, a fee-for service model rewards that mistake. In a bundled payment model, the hospital is less likely to be reimbursed for extra time due to a mistake. In the current environment, where hospitals are scrambling to keep up with demand, staffing firms can succeed by being quick to find talent. Over time, the most successful staffing companies may be those that provide the best candidate for the job and help their customers compete in a quality based world.