Recent trade tensions notwithstanding, Canada and the United States maintain a high level of economic interactivity due to shared cultural, political and economic practices, as well as the geographic proximity that comes with roughly 5,500 miles of shared border. As a result, those familiar with the US staffing industry may wonder how closely the Canadian industry resembles that of the US and vice versa. This article examines some similarities and highlights a few key differences between the two staffing markets.

Similarities

There are many similarities between Canada and the US culturally and economically, with high levels of education among both populations, a diversified economy and English as the predominant language (with the notable exception of French-speaking populations in Quebec). Both countries have a currency named “dollar,” although the Canadian dollar has been worth roughly 75% of the US dollar over the past three years. Economically, the two countries host a number of the same multinational corporations, and the two nations are major trading partners to the tune of more than $500 billion in goods exchanged each year. Canada and the US have developed economic cooperation in industries ranging from commodities to automotive manufacturing to professional sports, to give just a few examples.

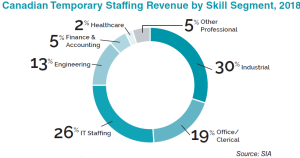

As the breadth of industries are similar in both countries, it comes as no surprise that the general structure of the Canadian staffing industry has many similarities with the US. Staffing of professional occupations comprises slightly more than half of Canadian staffing industry revenue, as shown in the accompanying graph, with the remainder split between industrial and office/clerical jobs. The most notable difference is that healthcare temporary staffing in Canada represents only 2% of the industry (compared with 13% in the US), as Canada’s government-run healthcare system has minimal use of staffing agencies. Nevertheless, as healthcare costs rise and efficiencies are sought, it remains an intriguing question as to whether a large healthcare staffing industry in Canada may one day emerge.

As the breadth of industries are similar in both countries, it comes as no surprise that the general structure of the Canadian staffing industry has many similarities with the US. Staffing of professional occupations comprises slightly more than half of Canadian staffing industry revenue, as shown in the accompanying graph, with the remainder split between industrial and office/clerical jobs. The most notable difference is that healthcare temporary staffing in Canada represents only 2% of the industry (compared with 13% in the US), as Canada’s government-run healthcare system has minimal use of staffing agencies. Nevertheless, as healthcare costs rise and efficiencies are sought, it remains an intriguing question as to whether a large healthcare staffing industry in Canada may one day emerge.

Another element that connects the Canadian staffing industry with the US and other large staffing markets is that the four largest staffing suppliers are also the four largest staffing firms by global staffing revenue: Adecco, Randstad, Allegis Group (Aerotek and TEKsystems brands) and ManpowerGroup. These four firms account for slightly more than one-fourth of industry revenue in Canada, according to SIA estimates.

Population Hubs

While there are many similarities between the US and Canada, one of the most important differences to grasp is the relative sizes of their populations, economies and staffing industries. Canada is home to 37 million people while the US contains 328 million. Canada has slightly fewer people than California (40 million), the most populous US state. The Canadian staffing market was $9.4 billion Canadian dollars (or $7.2 billion US dollars) in 2018, according to SIA estimates. While this is much smaller than the $147.8 billion US staffing market, the Canadian staffing market is nonetheless the 11th-largest country market in the world.

While the US contains several dozen major metro areas interspersed across the country, Canada has six particularly prominent metro areas: Toronto, Montreal, Vancouver, Calgary, Edmonton and Ottawa. Added together, these metros account for just under half of Canada’s population. The six metro areas are also located in four main provinces that account for nearly 90% of Canada’s population: Ontario, Quebec, British Columbia and Alberta.

Politics and Economy

There are a number of unique economic and political forces at play that help shape the environment for the Canadian staffing industry. At the national level, Canada allows a relatively high degree of immigration — more than 300,000 people each year are allowed to become permanent residents, an amount equal to roughly 0.8% of its population.

This high level of immigration is an important growth driver of both its population and the Canadian economy.

In terms of mix of industries, Canada’s large natural resources and energy sector means that its economy is more sensitive to fluctuations in the price of commodities than the US. As a recent example, the drop in oil prices at the end of 2014 quickly sent Alberta’s economy into recession in 2015 and 2016. The silver lining of such greater volatility in the Canadian economy is the potential heightened awareness of the value of temporary staffing for portions of the economy.

Trends in provincial government control are also noteworthy, due to recent changes and the fact that provincial governments have more power to set business regulations than states do in the US. British Columbia and Alberta are currently being led by the left-wing New Democratic Party, resulting in a minimum wage of $15 Canadian dollars in Alberta, the highest of any province, and opposition to oil and gas pipelines in British Columbia. Opposite trends are taking effect in Ontario and Quebec, where Conservative Party governments took charge in 2018, replacing several years of rule by the Liberal Party, and more business-friendly regulations are being enacted.

In summary, the Canadian staffing market is a dynamic industry that shares many of the strengths of the US staffing industry, while at the same time shaped by a uniquely Canadian context, and seems to contain much potential for growth both in the near and long term.