Transformative developments lead to a consolidating IT staffing market

The Herfindahl-Hirschman Index, or HHI, is a widely accepted measure of market concentration. Its calculation is

simply the sum of the square market shares for each firm of a market, typically limited to the 50 largest companies. A market with an HHI of less than 1,500 is considered a competitive marketplace, an HHI of 1,500 to 2,500 moderately concentrated, and an HHI of 2,500 or greater to be highly concentrated.

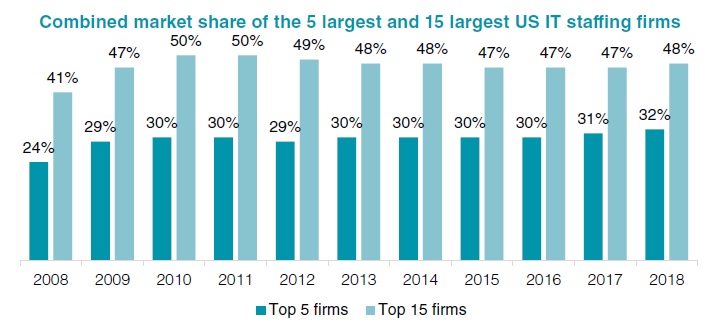

The HHI for the US IT temporary staffing sector is a miniscule 294, based on data compiled by SIA in its “Largest IT Staffing Firms in the US: 2019 Update” report — the most recent available. Of course, anybody in or around IT staffing does not need to calculate an HHI to be aware that IT staffing is a heavily fragmented market, particularly in the US where there are roughly 2,400 IT staffing firms alone. Indeed, the largest 15 US IT staffing firms represent less than half of the total sector.

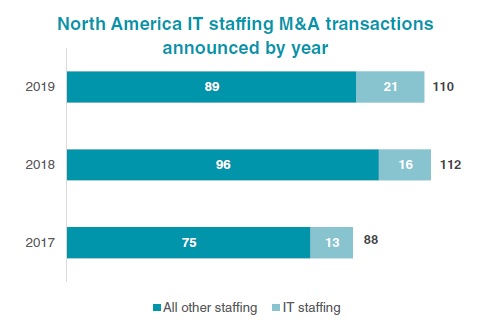

The fragmented market is largely attributed to low barriers to entry. However, we believe this era of extreme fragmentation is on the precipice of change. A range of factors are at play, many of which are either attributed to or accelerated by the Covid-19 health crisis. It is notable, however, as shown in both the charts that accompany this article, there were already early indications of consolidation prior to the pandemic. Current factors accelerating consolidation in IT staffing include:

Culling of highly exposed firms. The most unfortunate of factors is that an uncertain number of IT staffing firms are heavily exposed to the industries most impacted by lockdowns. Others maintained balance sheets ill-equipped to weather the oncoming storm. The unforgiving magnitude and sheer velocity of economic disruption brought on by the pandemic has afforded little time for these firms to reposition accordingly. The largest cohort of firms in this category will be found in the long tail of small “mom and pop” staffing agencies, but by the time the sector becomes well entrenched within a recovery, we anticipate some midsize staffing firms to be caught in the tide as well.

Market share mobility. Even among the surviving firms, some will greatly outperform others. The opportunities for IT staffing firms to capture market share have perhaps never been more transparent. While many firms are necessarily battening down the hatches, others are executing on all cylinders and investing in growth that will give them a distinct advantage coming out of recession.

Technology and automation. IT staffing firms that have already deployed automation tools into their workflows, or plan to do so near-term, will have a leg up on the competition. We believe technology will increasingly become a competitive differentiator in IT staffing as firms that are able to automate repetitive processes or leverage artificial intelligence/machine learning into sourcing processes, for example, hold a distinct advantage to more rapidly scale their businesses and capture market share.

Bargain hunting. M&A activity has been stifl ed against the current economic backdrop. Though cash is undoubtedly king right now, it is only temporary. Firms with financial flexibility, such as those backed by deep-pocketed private equity investors and those included on SIA’s list of the largest IT staffing firms in the US, may be better-positioned to be opportunistic in sifting through the wreckage and making acquisitions at depressed multiples. However, we do not anticipate uniform multiple compression across the sector due to our next point below.

Adaptability. Though IT staffing should fully recover as Covid-19 recedes, the pandemic’s influence will be lasting and transformative for the industry. To excel in the post-coronavirus era, staffing firms must be nimble to swiftly pivot to a rapidly changing demand environment. For instance, as some hard-hit industries will be slow to recover, staffing firms may seek acquisitions of suppliers with strong client relationships within more attractive industries.

Remote work. Another anticipated M&A tailwind is the pandemic aftermath will yield a step function in the prevalence of remote work. IT talent will demand it and buyers are becoming more receptive to it than ever before. A drastically wider talent pool to draw from will alter the trend of extreme recruiting difficulties of recent years. Small to midsize firms that operate within smaller geographic confines may consider merging with similarly positioned firms operating in complementary regions to expand their combined geographic footprints.

CIO priorities. Yet another driver of future M&A activity revolves around rapidly changing CIO priorities. For example, we anticipate a lasting acceleration of digital transformation projects. Strategic IT staffing leaders are always on the lookout for the next big category for staffing growth and M&A is one way a staffing firm can quickly capture specific skill set practices they think are most ripe for growth.

Consolidation in IT staffing could have significant implications, ranging from faster growth to greater operational efficiencies. For further reading and a comprehensive global analysis on the state of the IT staffing industry, we suggest downloading our recently published “IT Staffing Growth Assessment: 2020 Update.”