For years, SIA’s Pulse Report (based on our Pulse Survey) has offered a timely snapshot of staffing industry revenue, bill rate and order trends, recruiting/sales difficulty, and the future outlook for each staffing segment.

The Covid effect. When the Covid-19 pandemic first landed on US soil, its impact on staffing and business in general was uncertain. Early on, we decided to revise the Pulse Survey to capture coronavirus-related trends; every month since April, SIA has produced “Special Edition” Pulse Reports that contain both the standard Pulse data, which is already full of critical insights, and a number of new closed- and open-ended questions pertinent to the pandemic. These questions change each month.

In SIA’s US Staffing Industry Pulse Survey Report: June 2020 Special Edition Update, in order to capture the trend of office reopenings and the extent of business stabilization (or lack thereof), we asked the following pandemic-related questions:

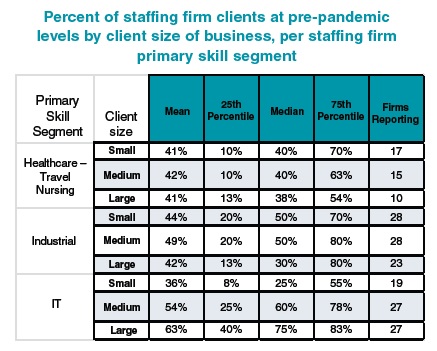

- “What percent of your clients … are doing staffing business with you at levels roughly similar to what they were before the pandemic?” Responses were requested for large enterprise clients (revenue greater than $1 billion), middle-market clients (revenue between $20 million and $1 billion), and small business clients (revenue less than $20 million).

- “What is your prediction regarding your firm’s percent change in staffing revenue when comparing 2Q20 vs. 2Q19?”

- And an open-ended question: “Have you begun to reopen offices for your internal staff? If so, what lessons are you learning as internal staff transition back to the office?”

A total of 179 staffing companies participated in the survey, including 30 with revenue greater than $200 million. And there was excellent participation on the new questions, allowing us to include greater color in our final report.

Respondents reported a median 40% of small staffing clients and 50% of midsize and large clients as doing business at pre-pandemic levels. This can be taken as a positive — after large initial downturns in most staffing segments, half of staffing clients were already returning to normal just months after a global pandemic began. Conversely, it can be taken as a negative — it could take many months, or longer, for the remainder of staffing clients to recover to their pre-pandemic levels, if they ever do. Additionally, some companies otherwise reporting growth could lose steam if the situation persists or worsens.

For a further breakdown on this same question, large IT staffing firms reported 75% of clients at pre-pandemic levels of business, while large industrial staffing firms reported just 30%. Based on these data, users of large IT staffing firm services have mostly been able to withstand the storm. Transitioning to working from home is not a problem for many IT professions (some are already remote positions), but it is challenging or impossible for certain industrial professions.

Second quarter. The stark reality of the pandemic’s toll on US staffing could be seen in the predictions for 2Q20 over 2Q19 growth. The survey found 165 respondents estimated a median 20% loss year-over-year. But there was large variation across segments. Travel nurse staffing firms predicted 15% year-over-year growth for the second quarter, whereas industrial staffing firms predicted a 30% decline in staffing revenue.

Reopening plans. It’s clear that the pandemic has put the staffing environment into a frenzy, but each company, each segment and each geography have been affected differently. In the open-ended comments about reopening, nearly the same number of companies had not yet reopened offices to internal staff (29) as had completely reopened (30). However, there were also many companies in between; 35 firms had either partially reopened or implemented flexible shift schedules. This arrangement of combining remote work with office work, as well as completely remote work (13 companies in our survey said they intended to work remotely on a longer-term basis), might represent the new norm for many businesses if productivity persists. As for the pandemic, challenges faced in reopening include developing health and sanitation protocols, managing office schedules, and addressing fear and uncertainty among employees.

Performance metrics. The July Pulse Report’s special section provides details into the nuances of staffing during the time of coronavirus. The regular section of the report, however, highlights some of the most important statistics of the month.

Median year-over-year revenue growth in May was down 18% for temporary staffing firms and down 29% for direct hire firms.

Each healthcare segment reported positive growth: travel nursing (21%), allied (11%), locum tenens (10%) and per diem (6%). All other segments reported negative growth, with the largest declines coming in industrial (down 29%), engineering/design (down 22%) and office/clerical (down 21%). Certainly, healthcare staffing segments, especially travel nursing, have performed better than other segments due to the need to provide care during the pandemic. And commercial staffing firms, with a high percentage of workers in warehouses and offices, have fared worse.

Average sales difficulty in May (3.80 out of 5.00) was still much higher than the average in normal times as the number had been consistently in the 2.60-2.90 range for four years prior to the pandemic. That being said, the number was down from the average sales difficulty reported in April (4.01). Furthermore, although 63% of companies reported a decreasing trend in new orders over the last three months, that figure was down from 73% in April, suggesting a stabilizing or upward trend. To add to this, 56% of staffing firms expected a positive trend in new orders in the next six months. This upbeat outlook was seen across staffing segments.

While it is undoubtedly difficult to see how things will play out in the US staffing market in the midst of vast uncertainty, capturing monthly trends through Pulse Reports at least gives us a glimpse into what is happening right now, and a reasonable idea of what might happen in the future.