No staffing executive heading for a relaxing holiday break at the end of 2019 could have foreseen the tumultuous events that would unfold in 2020. The year has placed extraordinary demands on every staffing business and completely reshaped the economic and social landscape.

As I write this article, six months after the World Health Organisation declared the Covid-19 outbreak a global pandemic, we still have no workable vaccine and, indeed, the threat of a second wave in many parts of Europe suggests the trajectory of a full recovery is going to be far from smooth. Nevertheless, I expect that, by the time the article is published, we’ll have more reasons to be optimistic and have clearer sight of the end of the crisis.

Mixed Outcomes

One of the most surprising aspects of the pandemic is the wide range of outcomes by country (though no country was completely immune from the global economic fallout). Asian economies have coped much better than Western economies, including the large economic engines of China and Japan. As of this writing, Taiwan has suffered about half the number of deaths (seven) as the Diamond Princess cruise ship (13).

Those international staffing firms operating in Asia will be thankful for their geographically diverse business portfolios. It should never be underestimated that geographical diversity is an effective defensive strategy and affords protection against unforeseen events such as the one we are currently experiencing. But there are also parts of Europe that are relatively unscathed and in a better position to emerge strongly out of the crisis.

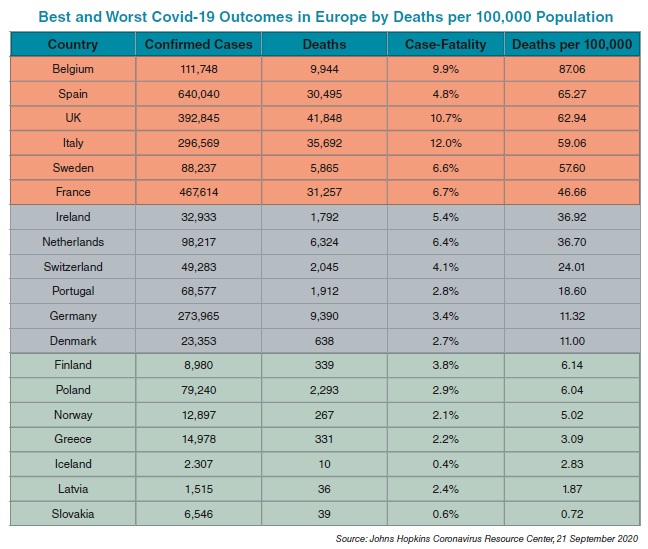

There has been a diverse range of outcomes across Europe (see the accompanying chart). In general, Nordic and Central/Eastern European countries have coped relatively well and smaller countries have done better than large countries.

There has been a diverse range of outcomes across Europe (see the accompanying chart). In general, Nordic and Central/Eastern European countries have coped relatively well and smaller countries have done better than large countries.

While the largest European staffing markets have generally suffered worse outcomes, it is notable that important markets such as Germany, Switzerland and the Netherlands have achieved relatively lower deaths per 100,000 and are, presumably, in a better position to rebound out of the crisis.

There are a number of theories as to why some countries have had lower mortality rates than others — mostly relating to the speed and execution of government decisions on lockdowns and other measures — but there seems more to it than that. For instance, why should the Belgian mortality rate be double that of neighbouring Netherlands, which had a relatively relaxed approach to lockdown, and how exactly has Greece outperformed every major

European economy?

While not entirely disconnected, the health outcomes of the crisis are not necessarily directly correlated to current economic outcomes. The most extreme example of that is the more laissez faire approach to health protection adopted by the Swedish government in an attempt to minimise the economic impact of the virus — the so-called “herd immunity” strategy. Though whether a mortality rate 10 times higher than its neighbour Norway can be justified morally is an entirely different issue.

The Economic Fallout

The economic effects are also quite mixed. Compared with the same quarter of the previous year, seasonally adjusted GDP in the second quarter of 2020 decreased by 14.1% in the European Union, according to Eurostat, the statistical office of the EU. Across Europe, GDP estimates varied from a drop of 22.1% in Spain to a decline of only 3.7% in Lithuania. The decline in the UK, now counted outside of the EU, was estimated at 21.7%. Of course, the UK faces an added Brexit deficit going into 2021, which is predicted to impair the economy further depending on the final outcome of negotiations with the European Union.

The Outlook

Expectations are that we’ll see a strong sequential bounce back in global GDP in Q3 2020 though it will still be lower compared with the same period in the prior year.

GDP plays an important role for SIA in calculating our staffing market growth forecasts, but other factors have to be taken into account as well including structural growth drivers and new legislation. And, of course, pandemic trends have also been added to the mix this year.

While each country is on its own trajectory, the common recovery pattern now emerging in most Western economies is that of a “swoosh,” reflecting a sudden fall, a quick partial recovery, but a slower path to a full recovery. Our current estimates under this scenario (due to be updated in October as this magazine issue goes to press) suggest a global staffing decline of 18%. Of the larger staffing markets in Europe, the UK is forecast to have the worst prospects in 2020, and the Netherlands the best (or “least worse” might be a more accurate description).

At the same time, we have not been able to eliminate the possibility of a worse outcome resulting in further halts to business activity. In the absence of a workable vaccine where lockdowns continue with ongoing spread of the virus, a ‘W’ shaped recovery is still a possibility for some markets. Under such circumstances, governments may also exhaust their ability to use monetary and fiscal policy for relief.

The good news is that staffing revenue is expected to increase in all countries in 2021 under either of these scenarios though, for many, the path to full recovery may continue through to 2022.

The structural growth factors that underpinned European staffing market growth in a number of countries pre-Covid have not gone away and, if anything, have been accelerated during the crisis, not least is the trend for organisations to transition their employee payroll from a fixed cost to a flexible one. Leaner and more efficient staffing firms emerging out of this crisis have every reason to be optimistic about the future.

For those interested in European staffing markets, SIA will be exploring opportunities and other issues at our Executive Forum Europe in December, which, given current circumstances, will be a virtual conference for the first time.