Of the many business trends kicked off in 2020, one of the most prominent was the accelerated digitalization of business operations. Global lockdowns forced companies to adopt internet-based technologies to stay in business and spurred consumers to use online services more often to perform daily activities and stay entertained. Nearly every industry was impacted by the shift to remote work and interfacing online, and staffing was certainly not an exception as various elements of the recruitment process relied on in-person communication and cooperation. While much of the staffing industry faced the challenge of adapting to the online environment, one subsegment of the staffing industry has thrived under these conditions: temporary staffing platforms.

SIA defines staffing platforms as online platforms that combine technology with traditional staffing pricing models. Staffing platforms streamline recruitment processes with features such as algorithmic candidate matching, digital credential verification, omnichannel notifications, AI-powered chatbots and GPS attendance validation. However, unlike talent platforms, which also offer many of these features, staffing platforms take on processes performed by traditional staffing firms, such as operating as the employer of record, onboarding and drug screening. Therefore, SIA categorizes staffing platforms as a subsegment of staffing in its “Workforce Solutions Ecosystem” report. Staffing platforms are further broken down into two types: hiring platforms, which provide place & search services, and temporary staffing platforms, which focus on temporary staffing services.

SIA estimates the global market for independent temporary staffing platforms (platforms that are not owned, developed or operated by a staffing firm) reached $1.6 billion in 2020. A majority of the market share was derived from commercial staffing segments such as industrial and hospitality. Commercial segments tend to be better suited to temporary staffing platforms than professional segments given their structured assignment lengths, fast time-to-fill requirements and higher repeatability of demand. A notable exception, however, is the healthcare segment, which shares similar characteristics and is served by many temporary staffing platforms.

Driving the Trend

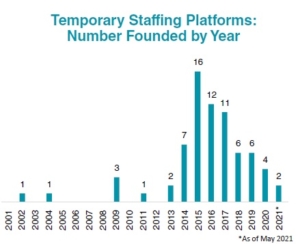

Although several temporary staffing platforms have been around for over a decade, most were founded after 2014. So why a sudden proliferation in recent years?

Digital generation. There are several driving forces attributed to the spike in popularity. First, online platforms in general are seeing rapid growth and adoption as younger digital-native generations begin entering the workforce. As for temporary staffing platforms, candidates are drawn to the convenience of quickly applying to a multitude of curated jobs once a user profile is set up, as well as simple digital onboarding and, in many instances, shorter payment cycles.

Tech advances. Second, technological advances in artificial intelligence and machine learning have made new features and efficiencies to temporary staffing platforms possible. These technologies power matching algorithms by generating a deeper understanding of candidates to suggest only the most relevant jobs.

AI chatbots can provide workers with technical assistance, shift reminders and onboarding, reducing the need for human recruiters. AI can also be used in scheduling, credential verification and skill assessments to make the application process faster for candidates and easier for recruiters.

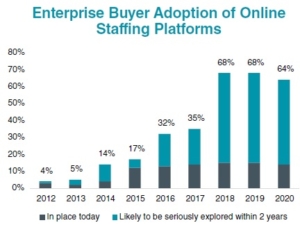

Time to fill. With expanding user bases and feature sets, temporary staffing platforms are able to fill shifts faster and reduce cancellations while keeping bill rates similar or lower than traditional staffing firms. These benefits have caused employers to take notice. SIA’s annual Workforce Solutions Buyer Survey found that 14% of enterprise buyers used online staffing platforms in 2020, and 50% plan to seriously explore using online staffing platforms in the next two years, up from 3% and 1% respectively in 2012.

Staffing interest. Finally, interest in temporary staffing platforms from traditional staffing firms have also contributed to the wave of new platforms. SIA’s February 2021 US Staffing Industry Pulse Survey Report found that 54% of surveyed staffing firms are already using a staffing platform or believe staffing platforms will impact the future of staffing. Temporary staffing platforms offer traditional staffing firms the ability to engage with more candidates per recruiter by automating typical recruiter responsibilities such as sourcing candidates, notifying workers about scheduled shifts and finding replacements for cancellations. Staffing firm Mitchell Martin launched its temporary staffing platform, Hyr, in 2015, followed by Adecco (Adia), Aya Healthcare (Aya Connect), Compunnel Staffing (Jobletics) and Integrity Staffing Solutions (FlexForce) in 2016.

SPaaS. The growth of temporary staffing platforms has also spawned another business model: staffing-platforms-as-a-service, or SPaaS. SPaaS providers offer white-label staffing platforms that can be customized to a firm’s specifications and, in some cases, be launched in a matter of weeks. SPaaS options can be easier to implement than developing a staffing platform internally or acquiring one, making it an attractive option for staffing firms looking to bring a staffing platform to market. Like their temporary staffing platform counterparts, SPaaS providers primarily serve shift-based commercial staffing segments. However, many SPaaS providers have expanded into professional segments as they build out new capabilities to create industry-agnostic platforms.

The ability to do business digitally has never been as important as it is now. Online platforms that can serve consumers with minimal human oversight experienced extraordinary growth over the past year and temporary staffing platforms were no exception. According to SIA data, several temporary staffing platforms and SPaaS providers saw demand more than double since the beginning of 2020. While this level of growth is likely unsustainable, temporary staffing platforms continue to grow their user bases and grab market share from traditional staffing firms as candidates increasingly turn to the internet to find work. The future of staffing is continually evolving, but in a constantly expanding online economy, temporary staffing platforms are looking like they are here to stay.

For a deeper look at the temporary staffing platform market, check out SIA’s “Temporary Staffing Platform Update.” This timely report includes an overview of the market with a look at trends, market size, primary providers and viewpoints from staffing firms, as well as directories of 60 independent and 13 staffing-owned temporary staffing platforms and 26 SPaaS providers.