Some common payroll issues staffing firms face and how to deal with them.

Payroll taxes are often complicated for companies with stable and settled workforces; staffing companies have all of the same issues as traditional employers, but with higher volumes and additional technical issues. While there are no easy solutions, below are some issues to be aware of and ideas on how to deal with them.

Proper classification. One of the first issues you will deal with is at the beginning of the hiring process: Are the people you are paying employees or contractors? This may seem like an easy question, but it often is not. The IRS has identified 20 factors to consider in making the decision. Many states are cracking down on employee misclassifications. If you have employees, then you will have employer payroll taxes, which will affect your costs. Understanding this will help you to price your work correctly and to avoid penalties, fines and other

annoyances that come with correspondence from state and local

agencies.

Agency communication. If you are contacted by a state or local government agency, address the correspondence in a timely manner. Some notices have deadlines to respond by, and if that time passes, there may be additional costs and fewer options on how to address it. Be careful in responding. While you obviously want to be truthful, there are many words that have one meaning in their common usage, but may have a different meaning in tax lingo. Providing more than you intended or other simple miscommunications can be costly.

Avoid notice. A way to avoid being contacted by the state is to register when and where required. With how fast things move in the staffing world, the changing nature of how and where people work is becoming increasingly complicated. States are still struggling to address these changes, and their solutions are not uniform. Once you determine you have an obligation to file in a state, registering may not be simple, as many states require separate registrations with their Secretary of State, Department of Labor and Department of Treasury or Revenue. Keep accurate records and making sure your accounting team is aware of when you have employees or customers in a new jurisdiction to help you maintain compliance.

Once you have registered and begun to collect sales tax or withhold payroll taxes, it is important that you remit these, as it is viewed as theft to collect the government’s money and not remit it. The cost of compliance might be high, but the cost of non-compliance may be higher.

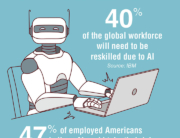

American employees want flexible work.

Forty percent of employed Americans reported that if they were looking for a job in the next few months, they would only consider work that was at least part time out of the traditional office; this includes 24% who said they would only consider hybrid work and 16% who would only consider remote work.