SIA projects US staffing market to increase 6% in 2013

As a staffing firm executive, you are tasked with growing your business and delivering a financial return to your firm’s owners. The good news is that your job is made a little easier by the fact that the U.S. staffing market is projected to grow 6 percent in 2013, a fourth consecutive year of expansion. So where is the growth happening? This article highlights the growth outlook for the U.S. market based on staffing sector and temporary help skill segment.

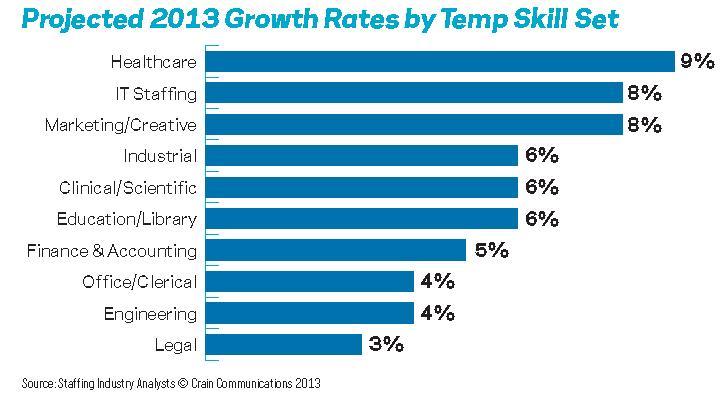

Fastest-Growing Markets

Temporary staffing of workers with healthcare skill sets is a market that we project to grow 9 percent in 2013, and gets the honor of having the fastest percentage growth rate in our forecast. The healthcare segment is still recovering from the recession as well as benefitting from strong demand for workers in preparation for healthcare reform. Also strong is IT, which is expected to grow 8 percent in 2013, as businesses continue to invest in technology as part of their business models. Similarly, staffing demand for marketing/creative workers is forecast to grow 8 percent this year. Although a small market of roughly $1 billion, the marketing/creative segment is seeing strong demand related to website design, mobile apps and social media campaigns.

Segments projected to grow a solid 6 percent this year include staffing of industrial workers, clinical/scientific workers and education/library workers. The demand for industrial workers is being fueled by a modest revival in U.S. manufacturing, construction and demand from the energy sector. Growth in the education/library segment is being driven by school districts increasing their use of outsourcing. More modest growth is expected for the office/clerical market, legal staffing segment and engineering staffing market, the latter held back by cuts in defense spending.

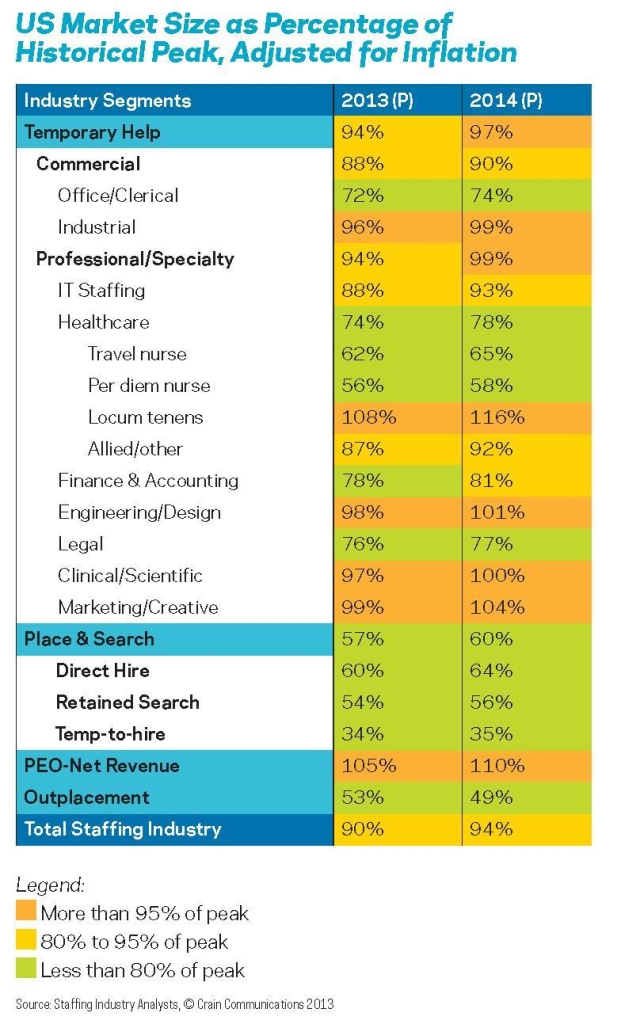

Historical Highs

Similar to the growth perspective, we also highlight the markets that are nearing or surpassing record levels of demand (adjusted to remove the effect of inflation.) In these high demand markets, and if supply of workers is scarce, staffing firms may benefit from a “seller’s market” with more pricing power — assuming they can recruit the needed talent. Market segments near or above historic levels include: the industrial, locum tenens/physician, engineering, clinical/ scientific and marketing/creative. In segments with high demand, make sure that you are pricing accordingly, especially in cases where recruiting is more challenging and where you are adding the most value to your clients. If recruitment times are longer due to scarcity, you may also want to communicate this to your client.

On the flip side, demand is currently much weaker than historical peaks in the following market segments: office/clerical, travel and per diem nurse, finance/accounting, legal, direct hire/permanent placement and retained search. In these markets, demand may still be recovering from recession-related declines. If supply of available workers remains ample, then these staffing markets may be “buyer’s markets” where staffing firms face lower prices and increased competition. A silver lining for these segments is that “market memory” of demand may exist among clients, implying potential growth in demand from firms already familiar with temporary staffing. However, loss of demand may also be caused by more permanent factors, such as the use of labor-saving technology in legal document review or the use of freelancers from online staffing platforms in place of office/clerical temporary workers.

More Upside Ahead?

The U.S. staffing industry is projected to reach a market size of $131 billion in 2013 and employ 2.7 million Americans. Our forecast of 6 percent growth represents a significant expansion of an already large sector of the U.S. economy, and is based upon an assumption of modest 2.2 percent GDP growth. There are at least two sources of potential upside to our forecast worth mentioning, given positive economic news in the first half of this year. First, the U.S. economy could continue to recover faster than expected, with the housing and construction industries growing and continued low gas prices. Second, the U.S. temp penetration rate, or proportion of temp workers in the overall workforce, could rise faster than expected, perhaps aided by some demand due to healthcare reform. Indeed, employment in the temporary help services industry rose 7 percent over the prior year in March and April, according to the U.S. Bureau of Labor Statistics. If that pace continued, the U.S. staffing market could see even greater growth this year. And that would be welcome news to both staffing firm executives and owners.