The staffing industry has deep roots in manufacturing, stretching back to the post-WWII period when the industry began to take shape. Today, manufacturing accounts for roughly 40% of staffing revenue in the US industrial staffing skill segment, or $12.2 billion in 2014 by our estimates, and thus remains a core industry vertical for industrial staffing. This translates to more than a million industrial workers on assignment on any given workday, in production, warehouse or skilled trades roles. If we include all skill segments of staffing — IT, finance/accounting, office/ clerical, etc. — we estimate the manufacturing sector spends more than $20 billion annually on staffing services. Here are current trends in the manufacturing sector, and four industries that offer attractive opportunities for staffing companies.

Strong dollar headwind. Contrary to long-term trends, the US manufacturing sector has been adding jobs over the past five years, prompting some observers in 2014 to declare a “manufacturing renaissance” in light of investments in new factories, including a new wave of hightech “advanced manufacturing” plants. However, year-over-year job growth in manufacturing decelerated throughout 2015 and ground to a halt at the start of 2016, with job levels stuck at 12.3 million, even as the overall US economy continues to add jobs.

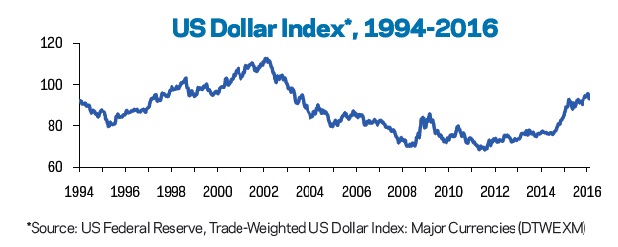

In addition to uncertainty in the US economy, the abrupt rise in the value of the dollar versus other currencies has arguably been one of the biggest headwinds for US manufacturing, or at least for firms with overseas customers. Not only does the strong dollar make US exports less attractive to foreign buyers, causing production and revenue pullbacks, but it increases the cost advantages of moving production offshore, eliminating manufacturing jobs. As shown in the graph, the US dollar rose roughly 25% from 2014 to the start of this year, although still remains within its historical range of the past two decades. The continuing economic weakness in Europe, Asia/Pacific, and emerging markets means that a strong dollar could be here for the near term.

Given this economic backdrop, we take a closer look at four US manufacturing industries that are growing and offer attractive opportunities.

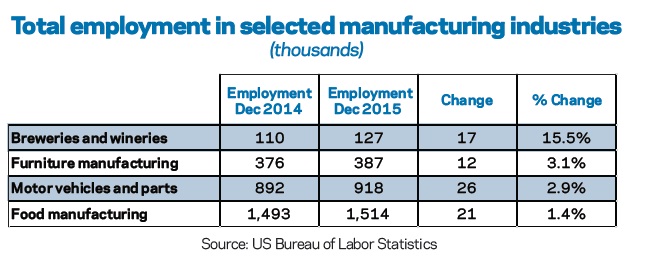

1. Motor vehicles and parts manufacturing. The motor vehicle and parts industry had another banner year in 2015, and ended the period with 918,000 jobs, representing 7.4% of all manufacturing jobs and 2.9% growth in jobs, as shown in the table. The auto industry was aided by pent-up demand from consumers who had put off new car purchases during the last recession and subsequent tepid recovery. In addition, new car interest was boosted by infotainment features such as built-in navigation, telephone and music capabilities. Due to complex and time-sensitive supply chains, the motor vehicle and parts industry has relied on staffing firms as key suppliers. The strong streak of growth has some observers calling the cycle at its peak. For example, more than $100 billion in subprime auto loans were issued in 2015, highlighting the amount of debt that is fueling purchases. Nevertheless, the current cycle has proved the success of automakers in the U.S.

2. Food manufacturing. Food manufacturing is one of the largest manufacturing industries, accounting for 1.5 million jobs at the end of 2015. Job growth has been modest at a 1.4% year-over-year pace. Staffing agencies offer a strong value proposition to this sector where agricultural deliveries are variable and speed-to-market is critical (or else the product spoils.) In addition, as many food manufacturers primarily serve the domestic market, the industry is less subject to offshoring of jobs. Growth is also being fueled by consumer shifts toward organic and locally grown food products. Retail and commercial bakeries were a particular bright spot, accounting for 230,000 jobs, and reporting 3% job growth.

3. Furniture manufacturing. Furniture manufacturing is a sector smaller than motor vehicles or food, but still accounted for a sizeable 387,000 jobs at end of last year, and an above-average job growth rate of 3.1%. Furniture sales have been boosted by rising disposable incomes and significant recovery in home sales. Similar to motor vehicles and food manufacturing which get much of their sales from the domestic economy, furniture makers have benefited from the strong dollar which has reduced raw material costs but not hurt sales. New products, for example mattresses containing technology features, have contributed to growth.

4. Breweries and wineries. Employment in the breweries and wineries industry (a segment of beverage manufacturing) has surged 15% over the past year to reach 127,000 jobs, by far the fastest job growth of any manufacturing industry with more than 100,000 jobs. Industry growth has been driven by rising disposable incomes, evolving consumer tastes for craft beers and wines, and the removal of some legal barriers that prohibited sales of alcohol across state lines. The brisk job growth in this sector suggests an opportunity for staffing firms.