A recurring theme at our staffing industry conferences is the advantages of “nichefying,” or being a specialist rather than a jack-of-all-trades firm. Typically, this means going after a specific set (or sets) of occupations, such as information technology jobs or marketing/creative roles. This fosters sales and recruiting expertise in specific job domains and leverages a database of candidates across multiple clients.

Yet, some firms have gone down a different path — specializing in certain categories of clients, such as financial institutions, hospitals or the government, which may involve a variety of occupations. For example, some staffing companies supply everything from nurses to janitors for hospitals. This approach comes with its own set of advantages, such as playing a consultative role in helping the client address industry-specific trends and challenges, as well as cross-selling to the various departments within an organization.

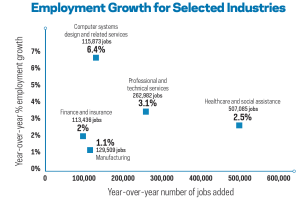

Still, many firms are somewhere in the middle, with a combination of occupation and industry specialization. In addition, there’s significant overlap between the two approaches — similar jobs tend to be furnished by similar companies. With that in mind, let’s examine recent trends (and potential staffing opportunities) in various industries, based on Staffing Industry Analysts’ Employment Trends by Geography Tool. According to a 2014 Staffing Industry Analysts report, the five industries most frequently served by staffing firms surveyed in three different years (2010, 2012 and 2014) were consistently manufacturing, healthcare, technology/ telecom, finance/insurance and business services.

Manufacturing. As of the third quarter of 2015, manufacturing employment was up 1.1% year-over-year as compared to a 2.1% jobs increase across all industries. Though growth in this industry has been lackluster, partially due to the strong dollar which makes manufacturing exports more expensive to other countries, there are a few strong subcategories and geographies. The two fastest-growing components of manufacturing are railroad rolling stock manufacturing, 11.1%, and beverage manufacturing, 7.2%; of the two, the latter is significantly larger in terms of employment. An increasing amount of freight traffic has been moving from trucks to railway cars, prompting hiring in this fast-growing space. On the beverage front, while US soda consumption has flagged, the demand for bottled water has surged.

On a geographic basis, the fastest-growing states in terms of manufacturing employment are Florida, 3.8% year-over-year, and Oregon, 3.7%.

Healthcare and social assistance. With more than 16 million Americans newly insured as a result of the Affordable Care Act, it’s no surprise that the healthcare industry represents a high-growth opportunity. The sector added more than 500,000 jobs year-over-year, or a 2.6% growth rate nationally.

Within healthcare, employment in outpatient care centers grew at the fastest rate of 5.2%. Outpatient facilities may employ not only traditional healthcare practitioners but also counselors, social workers, information and record clerks, and administrative assistants. The highest-growth states in the healthcare and social assistance category are Colorado, 5.1%, and Nevada, 5.0%.

Technology/telecom. The Bureau of Labor Statistics category that perhaps best captures trends in information technology industries is computer systems design and related services, which grew by an impressive 6.4% year-over-year. This primarily business-to-business (B2B) category grew somewhat faster than the more consumer-facing high-tech category of electronic shopping and mail-order houses (think Amazon and eBay) at 4.8%, and slower than software publishers, 6.9%. Hotbed states in computer systems design and related services include Kansas, 23.9% year-over-year employment growth, and Arizona, 12.8% growth.

In contrast to IT, telecommunications has taken a major hit, with a 3.1% year-over-year decline in wired telecommunications carrier employment and a 15.3% drop in wireless telecommunications carrier jobs. The telecom sector faces stiff competition from third-party voice applications such as Skype and WhatsApp.

Finance/insurance. While this industry’s employment growth of 2.0% is about average, a very large and fast-growing subcategory is insurance agencies and brokerages, which added more than 67,000 jobs and experienced a 6.7% growth rate. The profusion of new health insurance policyholders has contributed to the hiring in this sector. The fastest-growing states in terms of finance/insurance employment are Utah, 6.6%, and Arizona, 5.8%.

Business Services. This category maps loosely to the BLS’ professional and technical services. Bright spots within this catch-all B2B category include specialized design services, 4.4% year-over-year employment growth, and management and technical consulting, 3.3% growth. On a regional basis, Michigan, 7.9% year-over-year growth, and Missouri, 7.8%, topped the list.

While opportunities abound in these various industries, shifting your firm’s focus from an occupation-centered approach to an industry specialization brings its share of risks. Industries are more cyclical, whereas demand for particular occupations is diversified across a variety of sectors. Even government spending can be volatile, as any government staffing supplier can attest to from the fiscal cliff of 2012.

But whether you carve up your business in terms of occupation segment or industry vertical, it pays to be aware of industry-specific employment trends; your next big account might be lurking in one of the categories mentioned above. z