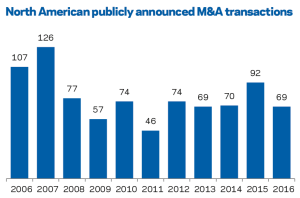

Merger and acquisition activity in the North American staffing market in 2016 was essentially in-line with the number of deals reported in 2013 and 2014, but fell 25% year over year. The 69 publicly announced transactions last year declined from 92 in 2015, which had been the most active year in staffing M&A since prior to the onset of the Great Recession, when 126 occurred in 2007.

Moreover, beyond the lower activity for the full year, the trend weakened as 2016 progressed. After a solid first quarter, each of the last three quarters of the year produced fewer deals than the corresponding period in 2015. The soft patch has carried into the new year as well, as the number of M&A announcements in the first quarter of 2017 also showed a moderate year-over-year decline. The same headwinds that have constrained recent growth in the US staffing market have been the primary causes of this downswing in activity — namely, subpar economic growth and heightened business uncertainty.

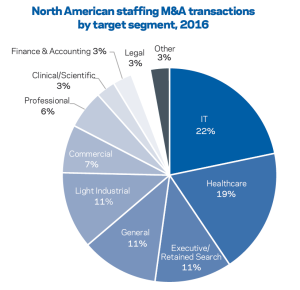

IT and healthcare were the staffing occupational areas that were most targeted for acquisition last year, with 15 and 13 deals announced, respectively. Volumes in both segments declined from 2015, however, as IT saw 23 acquisitions and healthcare had 22. There were eight transactions each in the executive/retained search, general staffing (i.e., those firms that are broadly focused across occupational segments) and industrial categories. Next were commercial firms — which are those that staff both industrial and office/clerical workers — followed by professional firms, which do substantial business across more than one professional occupational segment (e.g., healthcare, IT, and finance and accounting).

As the two largest segments within professional staffing by total revenue, it makes sense that IT and healthcare would receive considerable attention from prospective acquirers, both financial (private equity) and strategic (other staffing firms) alike. But scale alone does not tell the full story of what makes them so attractive. Both segments also boast relatively strong profit margins along with enticing long-term forward growth prospects. Expect IT and healthcare to continue to lead the industry in M&A volume in 2017, as they topped the rankings of preferred segments on our most recent list of companies looking to make acquisitions, combining to represent half of all firms’ primary targets.

Aside from the occupational focus, what other criteria are typically applied in evaluating candidates? Strategic acquirers often have well-defined priorities that may dictate a specific revenue range, geographic coverage, or composition and concentration of the customer base, among other considerations. Firms that are structured around high-volume supply of VMS accounts may use M&A primarily as a rapid way to add scale to their operations, and therefore be less concerned with the gross margin of an acquisition candidate. Others, especially midsize staffing firms, emphasize profitability above most other considerations, and are looking for acquisition targets that have direct client relationships and a premium margin profile.

Quantitative measures such as profitability tend to be the central focus of financial acquirers. But gross margin is not always the most scrutinized metric. Driven by increasing pricing pressure over the past decade as more contingent spend has been captured by VMS, and enabled by process improvements and technology adoption, the staffing industry has become far more operationally efficient. This has facilitated better management of operating expenses, allowing more gross profit to be converted into EBITDA (earnings before interest, taxes, depreciation and amortization), which is the figure most commonly used in valuing an acquisition.

It is an inconvenient reality that financial terms — meaning even purchase prices, let alone EBITDA multiples — are rarely disclosed when staffing acquisitions are announced, unless one or both parties happen to be publicly traded. Thus, we don’t have sufficient data from these transactions to serve as an indication of the overall trend in valuations. However, we inquire about acquisition multiples in our annual Staffing Company Survey, and the findings indicate they have remained roughly consistent in a median range of 3.5x EBITDA since 2011. Keep in mind, though, that the valuation of a given deal will vary significantly based on some of the evaluation factors we have discussed.

Looking Ahead

Somewhat counterintuitively, the year-over-year decline in M&A in 2016 may be a positive signal that the current economic expansion has some runway remaining ahead. Historically, recessionary periods have often been immediately preceded by peaks in M&A activity, as we saw most recently in 2007. Whether your firm is positioning for potential acquisition before the current window closes or assessing how conditions will support further growth in your business as we move later in the economic cycle, last year’s return to trend in M&A volume isn’t necessarily cause for concern.