Demand for temporary IT staffing is on the rise as suppliers benefit from numerous secular trends. For example, not only is IT spending growth accelerating, but the faster pace of technological innovation is fueling business requirements for more shortterm projects involving more specialized skill sets.

On the other hand, the supply of available IT talent in possession of these sought-after specialized skills is trending in the opposite direction. According to the US Bureau of Labor Statistics, the US unemployment rate for Computer and Mathematical occupations in the first quarter of 2018 was 2.1%. This is not only the lowest level since the second quarter of 2016, but also essentially half the rate for all jobs in the economy.

As the imbalance of supply and demand drift further apart, it forges a double-edged sword for staffing firms. On the plus side, buyers increasingly turn to staffing services in a tight labor market; this is, of course, offset to some degree as it becomes progressively more difficult to source quality talent. One question many staffing executives — and analysts like me — struggle to answer is whether we are in the zone where the pros and cons of a tight market are optimized for growth.

Select the Tools

There are tools at our disposal that can help us triangulate whether we are in this “Goldilocks Zone” for IT staffing.

The Pulse Survey. Each month, staffing firm executives taking part in SIA’s Pulse Survey rank their recruiting difficulty and sales difficulty on a scale of 1 to 5 (5 being most difficult). In the accompanying chart, analyzing results of only IT staffing firm participants, we have subtracted average monthly sales difficulty from average recruiting difficulty. We see recruiting difficulty (supply) generally becoming a more dominant theme relative to sales challenges (demand) over the past 18 months. Sustained values above zero could be indicative of a market where the shortage of talent is a net constraint on growth.

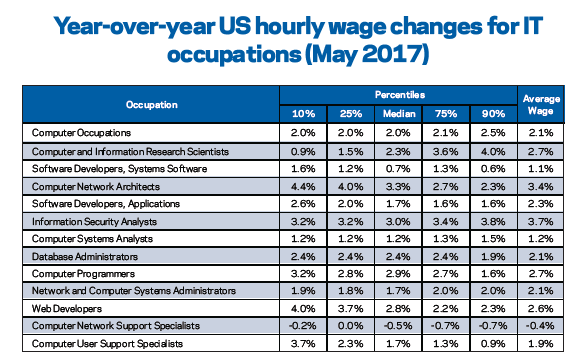

Wages. In theory, with demand held constant, a tightening supply should apply upward pressure on wages. Yet, even with an unemployment rate for IT jobs hovering around 2%, wage growth has remained stagnant. For example, the average wage for Computer Occupations increased only 2.1% year over year, according to recently released annual BLS data for May 2017. This matches the 2017 US inflation rate as measured by the Consumer Price Index.

Anecdotes. The third input we will look to in this analysis is feedback from conversations with IT staffing leaders. Executives we have recently spoken with are generally still not seeing signs of an acceleration in bill rate growth in the early going of 2018. However, supply constraints are evident in expanding time-to-fill ratios and a higher rate of conversions as buyers seek to seize scarce talent. Although most feedback we receive describes the skills shortage as growth constraining, there are some who view the imbalance as beneficial at current levels.

Triangulate the Data

We have conflicts across these indicators. It begs the question, “Why is it so difficult to identify the market sweet spot for staffing?” One primary reason is supply challenges are not uniform across IT. There are significant variances across industries served, geographic regions, and occupations/skill sets, for example.

Still, we believe the supply of talent has become scarce enough to serve as a net headwind on market growth. The corollary of tepid wage growth is that we have not yet reached levels where buyers are broadly compelled to make significant upward revisions on their rates to secure talent. However, with the added nudge from tax reform, we expect the wage disconnect to ultimately correct, perhaps in the second half of 2018.

Staffing executives cannot necessarily change supply and demand trends, but they can adapt. There is ample opportunity to carve out your own Goldilocks Zone. Whether by industries served, geographies, occupations/skill sets, or technology platforms, firms can sharpen their specializations where the pockets of opportunity dictate.