The US finance and accounting temporary staffing market grew 2% in 2017 and is projected to grow another 4% in 2018, reaching a market size of $8.1 billion, according to Staffing Industry Analysts. Earlier this year, SIA released its first-ever growth assessment of the F&A temporary staffing market — available to our corporate members. This relatively fragmented market comprises many smaller firms that capture less than 1% of the market. Here are two key takeaways from the report.

Industry verticals

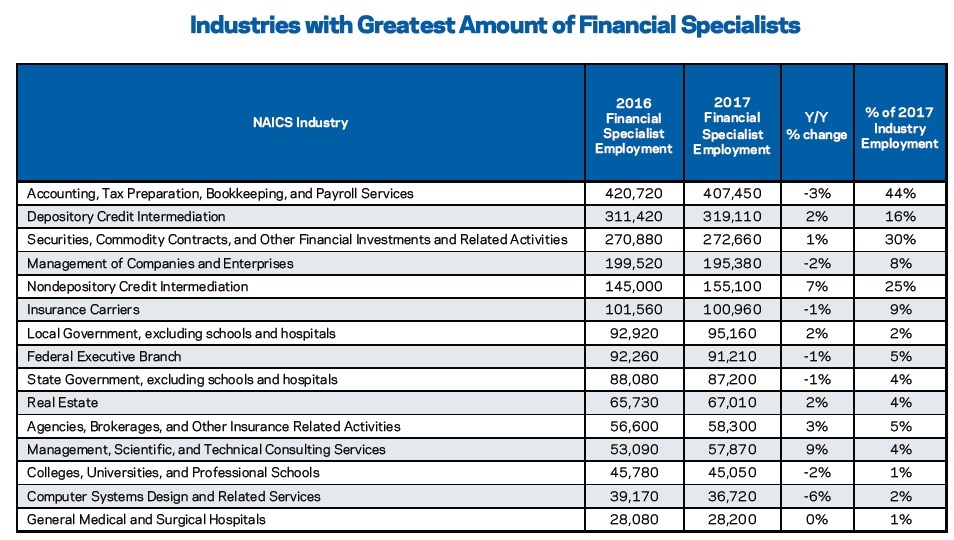

The F&A staffing market is highly competitive, where many of the largest firms have market shares that are in the low single digits. One approach to differentiate is to choose a specific industry vertical to supply to and dominate in that niche. The accompanying chart shows the 15 industries that employ the largest number of financial specialists and financial clerks, two broad categories of finance and accounting occupations. Note that we differentiate between financial clerks (operational, clerical roles) and financial specialists (financial managers, accountants and auditors). While both may often work in a similar setting, financial specialists typically have greater required skills and responsibility.

While all industries need finance & accounting support, what is less obvious are the largest industries in terms of F&A jobs along with the roles that are unique to each vertical. The most common roles across all industries were “accountants and auditors” and “bookkeeping, accounting, and auditing clerks” for financial specialists and financial clerks, respectively. That said, here are some unique roles that were found in certain industries:

Starting off with the credit intermediation verticals, which includes commercial banks and financing companies, we see that financial specialist employment grew year over year, particularly in the non-depository vertical (i.e., credit card issuing and financing companies), while clerical growth was negative. The most common title for financial specialists was loan officer. Other notable roles included credit analysts, financial analysts and personal financial advisors. As for financial clerk employment, tellers comprised by far the largest chunk, making up almost 480,000 jobs — a surprising figure given the widespread adoption of ATMs and online banking. That said, while teller roles are bound to become automated away, the “customer service representative” position could be viewed as a likely transition as many of the skills are supplemental to a teller’s current role and it is less threatened by end-to-end automation.

Another financial service-related industry is the “securities, commodity contracts, and other financial investments and related activities,” a North American Industry Classification System (NAICS) category that encompasses investment banks, security/commodity brokerage and exchanges, and investment management. This industry is primarily served by financial analysts and advisors.

We often may look past the public sector when examining industries, but there happens to be a large proportion of financial talent employed by local, state and federal governments. We note that there was an especially large concentration of “tax examiners and collectors” in these settings. Employment of these workers will depend primarily on future changes to government budgets. At the federal level, the Internal Revenue Service, the primary employer of tax examiners and collectors, has experienced severe budget cuts, prompting an 8% decline over the next 10 years, while budgets at the state and local level have been more stable, with employment expected to grow in line with state and local government growth.

One last role worth highlighting here is within the real estate industry. In this category, we see a large share of financial specialists with the role of “appraisers and assessors,” defined as providing a value estimate on land and buildings before they are sold, insured, or developed. According to the US Bureau of Labor Statistics occupational outlook handbook, employment in this occupation is expected to grow faster than average with a projected growth of 14% over the next 10 years.

We note a decline in year-over-year growth in financial clerk employment across the largest industries. This is likely due to the increasing sophistication of accounting software that has eliminated many bookkeeping roles. While the bookkeeping industry is not poised to disappear overnight, automation is likely to continue to replace clerical jobs. In response, staffing firms may wish to increase focus on upskilling employees or seeking out new talent pools.

Finance and accounting staffing company results

Public company earnings can be a helpful guidepost to use when reflecting on the performance of your staffing firm.

In the first quarter of 2018, Robert Half, by far the largest supplier of F&A temporary staffing, reported global revenue growth year over year of 6.6% and 7.0% in its Accountemps and Management Resources divisions, respectively, on a same-day, constantcurrency basis. Year-over-year growth in its Accountemps division, which had lagged behind Management Resources on a quarterly basis, finally caught up in the first quarter of 2018. In its earnings call, the company mentioned that the strong growth was due to a combination of both broad-based demand and increased bill rates.

Also in the first quarter, Kforce’s FA Flex segment experienced a 7.9% year-over- year revenue decline, which is a continuation of year-over-year declines since the first quarter of 2017, although the company attributes this slowdown to spread compressions and difficult comps rather than the F&A staffing market as a whole. During its first-quarter earnings call, the company mentioned a double headwind from larger-than-anticipated assignment ends along with lower-than-anticipated assignment starts.

Given the competitive environment of F&A staffing, we hope that staffing firms will find value from these insights when looking for ways to add a competitive edge in an already challenging recruiting market.