Expanding a staffing operation into a new country can be a lucrative growth strategy, but it also comes with a unique set of challenges such as barriers in language and culture, potential currency risk — due to exchange rate fluctuations — and selecting the right people to develop a business. But before any of those concerns can be considered, the first step is to evaluate which country market to enter in the first place.

This is no easy endeavor as there are many factors to account for, such as market size, competitive landscape and economic growth potential. Creating an exhaustive list of all these factors and collecting all the data for comparison is a daunting and time consuming task. So how does a staffing firm executive even begin evaluating which country to expand into? For that, let’s turn to SIA’s Most Attractive Staffing Markets dashboard, an interactive tool that compares over 60 country staffing markets across six continents.

In this tool, we have developed a holistic methodology for evaluating the potential of each country staffing market using the following 10 indicators: market size, protection of permanent employees (stronger protection implying increased demand for temporary staffing), regulations on temporary agency work, ease of doing business, economic growth, short- and long-term staffing market growth, market competition, political stability, and human capital. We then assess each indicator for a particular market on a 10-point scale, with 1 being relatively least attractive and 10 being most attractive. Countries are then ranked based on their total score. (More information about each indicator, and its underlying data source, can be found in the tool’s note section, as well as in our Most Attractive Staffing Markets Globally 2019 report.)

Because firms may place higher importance on different indicators, the tool enables users to adjust the weight assigned to the factors; users can even ignore select factors altogether when evaluating a market’s score. Therefore, if a user finds GDP growth to be more important than political stability, that company can easily customize the tool’s ranking algorithm so that the top-ranked country markets best align with the company’s strategic priorities.

Once a user has adjusted the evaluation to his or her liking, the sortable table is populated with ranks of each market based on the total of each indicator’s score. The tool also generates a world map that helps users visualize attractive hotspots. In addition to serving as a visual aid, the map may also be used as a filter, limiting the table to only those areas that are selected. For instance, if a user is only curious about markets in Europe, he or she can limit the scores to markets that pertain only to that region.

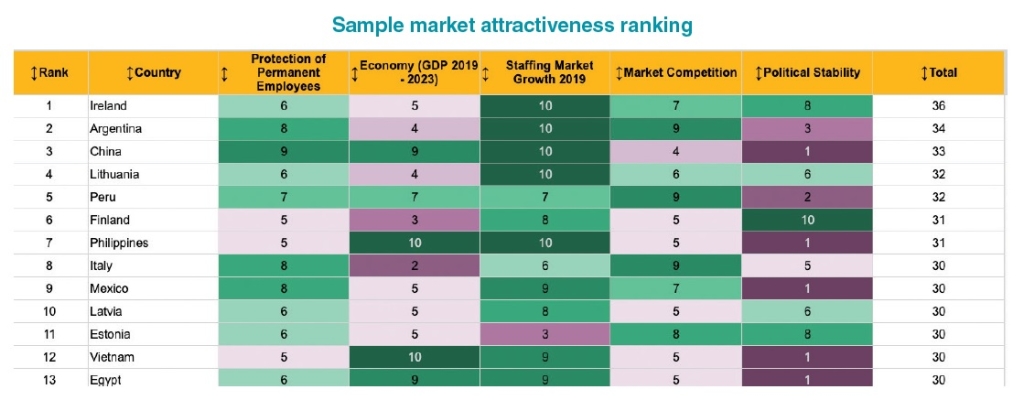

The accompanying table shows the 13 most-attractive country staffing markets based on five select criteria of the 10 possible ranking variables available in the tool.

In its default setting, the tool ranks country staffing markets using the 10 aforementioned variables. Within this framework, the most attractive market, with a six-point lead, was Ireland, touting a strong forecasted market growth, a favorable market to new entrants, and a relaxed regulatory and business environment. For further analysis, we invite corporate members to review our Most Attractive Staffing Markets Globally 2019 report for an in-depth commentary on the highest- and lowest-ranked markets across all 10 valuation factors.

While expanding a staffing firm’s geographic coverage requires an immense amount of due diligence, the first step of evaluating countries for possible expansion can be quite complex due to all the varying factors and research that is necessary. We hope that executives can leverage this tool when undertaking the first step of the process.