Planning for the future is a critical aspect of managing any organisation. The long-term success of a company is closely tied to how well the management can foresee its future and develop appropriate strategies to deal with likely future scenarios. Additionally, with more staffing firms looking to expand internationally, market size estimates for major staffing markets around the world take on added importance. An accurate figure for the scale of your addressable market is a critically important data point for effective management. A recent report published by Staffing Industry Analysts helps to fill in the blanks.

Published twice annually, SIA’s “Global Staffing Industry Market Estimates and Forecast” report provides estimates and forecasts for the staffing industry by revenue, including regional and historical data and a ranking of the 14 largest countries in terms of staffing industry revenue. Staffing companies can use this report to benchmark their performance against market trends. Furthermore, the market projections available in this report should be useful to potential investors. The full “Global Staffing Industry Market Estimates and Forecast” reports are available for SIA corporate and CWS Council members.

Existing Landscape

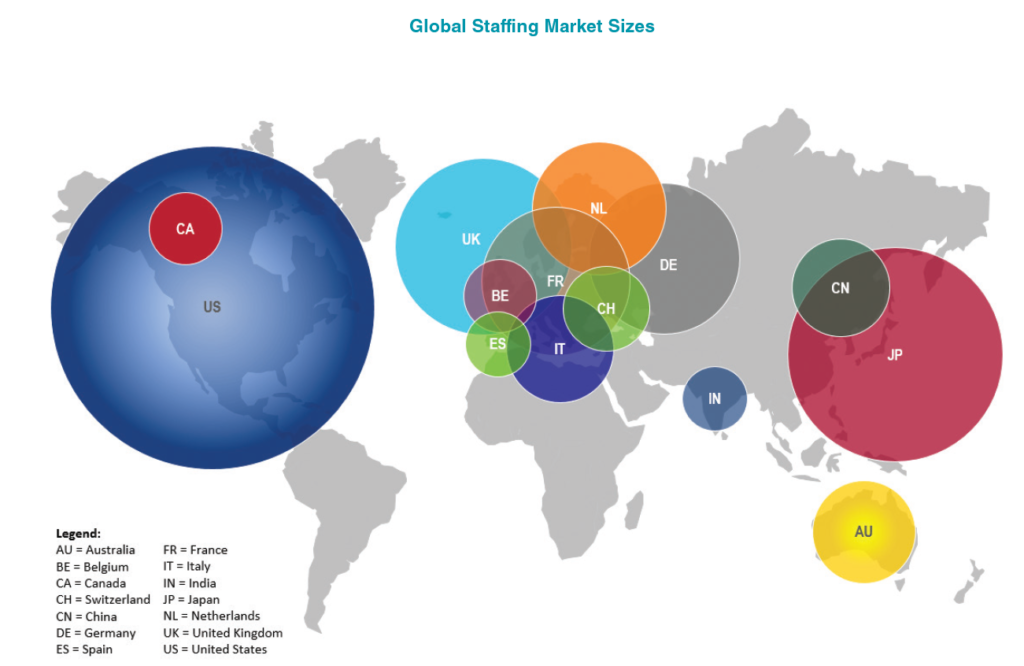

Our May 2019 report estimates the global staffing industry generated US $490 billion in revenue in 2018 (€415 billion), representing 5% growth from 2017. In calculating our estimates, we split staffing into two main service categories: temporary staffing and place and search (direct hire and retained search). Eighty-nine percent of global revenue was generated via temporary staffing, with the remaining 11% stemming from place and search. The majority of revenue was generated from only three countries (US, Japan, UK), while the bulk of staffing industry revenue is concentrated in a relatively small number of countries. Given the dominant share represented by the largest 14 markets, these countries tend to drive global and regional trends. Each of these countries is represented in the map on the next page by a “bubble” that is proportional to its staffing market size.

Our May 2019 report estimates the global staffing industry generated US $490 billion in revenue in 2018 (€415 billion), representing 5% growth from 2017. In calculating our estimates, we split staffing into two main service categories: temporary staffing and place and search (direct hire and retained search). Eighty-nine percent of global revenue was generated via temporary staffing, with the remaining 11% stemming from place and search. The majority of revenue was generated from only three countries (US, Japan, UK), while the bulk of staffing industry revenue is concentrated in a relatively small number of countries. Given the dominant share represented by the largest 14 markets, these countries tend to drive global and regional trends. Each of these countries is represented in the map on the next page by a “bubble” that is proportional to its staffing market size.

Looking Ahead

Now that we have a clearer understanding of what happened in 2018, what does this mean for 2019? Short of a global economic downturn, the easy answer is pretty much “more of the same”: We are forecasting that global staffing markets will continue on the same trajectory as 2018, growing by 4% in 2019. Despite uncertainty in certain markets, the strong secular trends and favourable regulatory changes in others, combined with expanding multinational contingent workforce programs, signal balanced industry performance worldwide.

One pessimistic note is that staffing markets are decelerating in continental Europe, as consumer and business confidence has weakened. Last year, growth in the German market decelerated from 7% to 2%, and we project further deceleration to 1% this year. Figures from Germany’s Federal Statistics Office show the economy slowed sharply in the second half of 2018, driven by a weaker global economy (nearly half of German GDP is export-related) and a sharp decline in the automotive industry, caused in part by new pollution standards.

Another significant headwind in Germany has been the new limitation of assignment lengths to 18 months. However, the slowdown in temporary agency work has been slightly offset by strength in permanent placement as, in some cases, clients are converting temporary workers to hires once assignments end. In the United Kingdom, meanwhile, there are major questions surrounding Brexit, although the market seems to be achieving steady if unspectacular growth.

Talent Shortage

One point of contention is the effect the increasing lack of available talent will have on staffing market growth, especially in high-skilled professional staffing sectors. Are the skills shortages a headwind or a tailwind for staffing industry growth? As the imbalance of supply and demand drift further apart, it forges a double-edged sword for staffing firms. On the plus side, buyers/end-users increasingly turn to staffing services in a tight labour market; this is, of course, offset to some degree as it becomes progressively more difficult to source quality talent. The delicate balance between a tight labour market and talent shortage is more apparent in mature staffing markets such as Germany as well as professional sectors such as IT and engineering.

If you want to know more about all our forecast, you should listen to the replay of the webinar we broadcast for the APAC region on 1 May, “APAC SI Report Webinar – May 2019.” You should also put 15 October in your diary; in that edition of the SI Report webinar series, we will take a detailed overlook at the EMEA region. If your membership only covers one region, reach out to memberservices@staffingindustry.com to arrange access to these webinars.

Using our forecasts to identify and target high-growth staffing markets is only the first step on the journey to company growth. A company strategy also requires considerable planning, resources and management expertise to be successful. It is equally valid that, regardless of what the data says, growth can be found in any market with the right strategy, the right people and the right execution. However, what our forecasts show is that the staffing market in 2019 remains an exciting place to be.