Scouting out an acquisition target, or seeking a buyer, requires a significant amount of homework. Buyers and sellers need access to databases of companies, which they then need to narrow down based on potential interest/ fit. After time-consuming legwork, companies can cross off names one by one, until finally they come up with realistic short lists.

This process would be much more efficient if there were a list of companies that already indicated interest in making acquisitions, as well as their targeted segments and regions. SIA’s “Companies Looking to Acquire Staffing and Workforce Solutions Firms: 2019 Update” report offers this, and more.

Armed with the data in this report, users can get a sense of the appetite for acquisitions across geographical regions and industries. Staffing firms seeking partners/investors/buyers can certainly benefit from quickly being able to see the market sentiment in their respective fields.

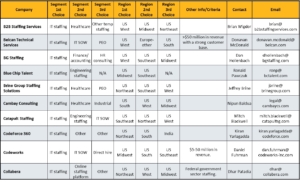

Let’s consider a hypothetical example of how a company could use the report and connect with potential buyers. “Chicago IT Temps,” a Chicago-based firm with about $25 million in annual revenue, wants to gauge interest in its business. The company first looks at the list in this report and focuses on companies that listed “IT staffing” as their first choice for acquisition segment, which yields 44 results.

Overall, about 46% of firms listed in the report selected either healthcare or IT staffing as their first choice in segment. This corresponds with actual M&A activity in 2018, as detailed in SIA’s “North America Staffing Mergers & Acquisitions: 2019 Update.” Of the previous year’s reported M&A deals in North America in 2018, the two most popular staffing acquisition areas were also healthcare and IT, combining for 26 and 16 of the year’s 108 staffing deals where the target was headquartered in North America, respectively. This year’s interested companies, however, expressed evenly proportioned preferences across those two segments (23% each).

Healthcare has been booming but has slowed a bit recently, in part due to the number of Americans insured under the Affordable Care Act declining after a rapid increase in 2015 and 2016. Meanwhile, IT has been experiencing secular growth, with fierce competition that has not let up, which might explain the slight shift in demand toward IT.

Returning to our fictitious seller, Chicago IT Temps recognizes there are many buyers of IT staffing from which to choose, and turns to the “Region 1st Choice” column. It first looks for companies that listed “US Midwest” as their top preference. In fact, on page 17, two of the IT staffing-seeking companies have selected the Midwest as their top choice in region. In 2018, acquisition targets were most often in the Southeast (35% of all deals) and the Northeast (22% of all deals). Although the breakdown of regions differs slightly for potential acquirers in 2019, the same two regions are the most popular. This year, the Northeast was the top-choice segment for 33% of participating firms, and the Southeast 20%. As for the Midwest, the number of staffing deals in the region notably jumped from 8 to 15 between 2017 and 2018, representing 14% of all deals. There is still momentum in the region, but it appears the trend has slowed; the Midwest was the top-choice segment for 16% of firms looking to acquire so far in 2019.

Chicago IT Temps knows its Midwest business will draw interest among some of the buyers on the list. But before moving over to the contact information, the company should look at the “Other Info/Criteria” column, which enables acquirers to be more specific about the exact types of companies they seek and provide important considerations in their search. On page 17, Chicago IT Temps sees that a company called Codeworks has mentioned it wants companies with $5 million to $50 million in revenue. Depending on whether Codeworks’ business line is a match, Chicago IT Temps can make a business conversation with Codeworks its top priority.

Blue Chip Talent is another company seeking Midwest acquisitions. With two great leads, Chicago IT Temps can then turn to other pages to find the other buyers specifically looking for IT staffing companies in the Midwest. Finally, the company can look for IT staffing in the Midwest among acquirers’ second and third choices in segment and geography, respectively, to establish lower-priority yet still high-quality contacts.

In summary, selling companies can use this report to aggregate interested parties, perform due diligence, learn about the operations of companies they are not familiar with, and gather direct contact information. But this report is not only useful to current sellers. Acquiring companies on and off the list can get a feel for the level of competition they will face in making acquisitions. Parties involved in the staffing industry can use the trends visible in this report to approximate the direction of the market. And non-selling businesses can put themselves in a position to eventually sell.