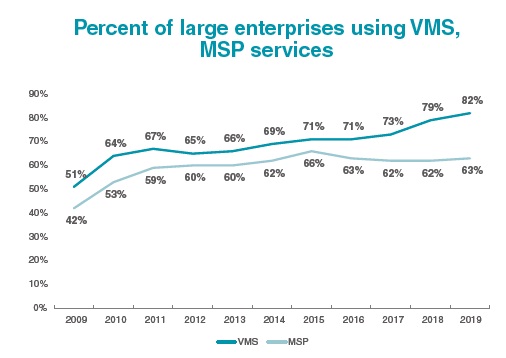

The use of vendor management system technology and managed service provider services has become increasingly widespread at midsize to large enterprises over the past decade. As a result, a key strategic concern for many staffing companies is not only how to delight the underlying enterprise client, but also how to partner effectively with that client’s VMS provider and MSP operator.

Professional Basics

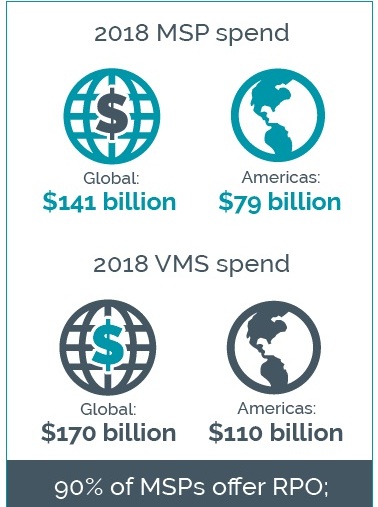

Global spend via VMS grew 10% in 2018 to reach $170 billion, according to Staffing Industry Analysts’ estimates. Nearly two-thirds of this spend occurred in the Americas region, where spend increased 9% last year to $110 billion. The increase in spend was riven by companies adopting VMS for the first time as well as by companies with an existing VMS growing their spend and expanding the types of spend managed by their systems. Regarding the latter, a key evolution of VMS capabilities involves the procure-to-pay cycle of spend on statement-of-work projects and outsourced services. This is in addition to the core mission of managing temporary worker and staffing supplier spend. Another expansion in capability: VMS offerings that support direct sourcing, the ability to curate and engage a pool of already-identified talent as a means of obtaining contingent workers directly without needing a staffing firm.

VMS providers also continue to differentiate based upon whether they have more of a spend management focus or a talent focus. This correspondingly aligns with whether the client’s procurement or HR group plays a greater role in leading an enterprise’s contingent workforce program.

SIA’s recently released VMS Landscape report also discusses a number of new features being offered by VMS providers, based on responses from 16 VMS firms, ranging from large providers Beeline and Coupa to smaller niche platforms. User interface and mobile app/device functionality continue to be areas of constant innovation and improvement, with VMS platforms typically offering basic time and expense approvals by hiring managers or program managers, and increasingly offering a broader set of services — including requisition and contract management via mobile device. Regarding workforce planning and benchmarking, some VMS providers offer predictive analytics and cross-customer benchmarking built into the tool to provide a higher level of analysis and market intelligence beyond traditional dashboards of metrics. Other technology advancements include the use of AI engines to help with résumé parsing and candidate matching, as well as voice recognition functionality.

Trends With MSP Providers

SIA’s Workforce Solutions Buyer Survey suggests that a majority of large enterprises use MSP services, although use is not quite as widespread as VMS. The gap is explained by enterprises that use a single master vendor or have an internally managed contingent workforce program instead of using an MSP. SIA estimates that global spend via MSP was $141 billion in 2018, an 8% increase over the prior year. MSP spend in the Americas was $79 billion, a 1% increase. The slower growth rate represented a bit of a pause after growth in prior years, and also some degree of market saturation.

SIA’s MSP Landscape report contains a variety of findings collected from surveys and interviews with 26 MSP providers, accounting for a combined $101 billion in spend in 2018. The report identifies the five largest providers in alphabetical order as Allegis Global Solutions, KellyOCG, Pontoon, Randstad Sourceright and Tapfin — all with more than $6 billion in annual managed spend.

Key trends among MSP providers include investments in MSP staff for training and retention, greater service offerings for midmarket clients, and more offerings involving RPO and total talent management. Regarding staff training, MSP providers continue to see staff quality and consistency as a key driver of service quality, both for their client-facing on-site staff as well as for their employees in centralized and offshore delivery centers. Regarding midmarket clients, MSP firms continue to expand their customer base with midsized firms, in some cases offering streamlined programs or programs serviced by delivery centers to be more cost effective. Lastly, regarding total talent management, 90% of providers in the MSP Landscape study offer RPO services, and 15% of contracts feature MSP and RPO together in a single agreement.

Into the Future

As spend flowing through VMS and MSP continues to grow globally and in the Americas region, staffing suppliers have a large market opportunity if they are able to meet the demanding needs of enterprise and midmarket employers. And as client sophistication and technology continue to advance, VMS and MSP providers will keep pushing the envelope in terms of the quality and variety of services they aim to deliver across an increasingly global scale.