The motivation behind such deals differs by buyer type.

Private equity. Financial buyers have just one motivating factor to engage in M&A: profit. Private equity firms typically seek to identify companies that appear undervalued or are otherwise lagging competitors, acquire them, then set about the business of cutting costs and enhancing revenue opportunities, often initiated with the installation of a new management team.

Private equity firms may also acquire companies that are complementary to one(s) already in their portfolio with the intention of integrating the entities to create a more robust combined organisation. The desired end result is that the acquired business(es) can be turned around and sold — often in a public stock offering or to another corporation — for a return above what the firm outlaid in its acquisition and reorganization

Staffing firm. The specific priorities that a given staffing firm may have in pursuing an acquisition are manifold, but in any case, such an initiative signals that company management perceives a better potential return by deploying capital outwardly than by reinvesting in the business. In contrast to most other industries, intellectual property and physical assets such as production facilities and equipment are not significant determinants of competitive advantage in the staffing world, and thus do not play a primary role in the M&A decision process.

In evaluating potential acquisition targets, a staffing firm typically seeks to offset weaknesses in its current operations or tap into the growth potential of a market in which it has not been a significant player. This may mean looking to buy a firm that is a leader in supplying an emerging skill set where the acquirer was not positioned to benefit from the rising demand. An additional priority could be to expand its presence into a new geographic area.

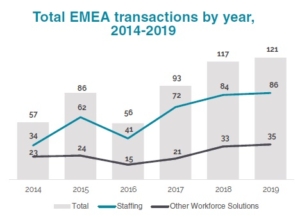

While M&A activity has increased in EMEA in the past year, what will the effect of the Covid-19 pandemic be on the number of completed deals this year? During the continued growth of publicly announced M&A transactions in EMEA over the past several years, it has at times felt like the M&A market had become impervious to external shocks. While all cycles do eventually end, few envisaged that it would be one catastrophic event that would eventually suppress M&A activity, but the onset of the Covid-19 pandemic has done just that — at least in the short term.

The pandemic has been having a dramatic effect on all industries in all countries and the workforce solutions ecosystem is not immune to the disruption. This is partly because the staffing industry, in particular, relies on the forward business confidence of clients. Any downturn can be incredibly challenging for staffing firms because the value proposition to clients is explicitly geared to flex up when demand is high and flex down when demand is low.

The pandemic has been having a dramatic effect on all industries in all countries and the workforce solutions ecosystem is not immune to the disruption. This is partly because the staffing industry, in particular, relies on the forward business confidence of clients. Any downturn can be incredibly challenging for staffing firms because the value proposition to clients is explicitly geared to flex up when demand is high and flex down when demand is low.

The attention of many businesses in the past few months has been on cash management and self-preservation, not acquiring other firms. Transactions that are deep into due diligence and/or the documentation phase may still close over the next several months. However, M&A discussions in the earlier stages of the process are more likely to be placed on hold until there is better visibility into the business performance impacts resulting from the pandemic.

M&A Deals Amid Covid-19

Despite the global slowdown in the transactions pipeline, however, there remain drivers for activity for certain types of deals. In this environment, for example, completed deals may well involve distressed businesses, with leading companies acquiring struggling firms. Previously successful businesses can quickly come unstuck by a rise in bad debt, or too great an exposure to one client in one part of their business. In these cases, buyers may prefer an asset purchase to acquire only parts of a target they want (avoiding historic debt or disputes), rather than a 100% share purchase.

Similarly, the pandemic and associated lockdown have served to accelerate digital transformation across the workforce solutions ecosystem. This may translate into more M&A deals and investments that help accelerate the digital transformation of the buyer with larger companies continuing to buy stakes in technology companies rather than wait for in-house development projects to come to fruition.

Opportunities Ahead

As the financial markets stabilise and when companies gain a greater understanding of the consequences resulting from the Covid-19 pandemic, opportunities will arise for the right buyers and sellers to return to deals that were in the pipeline or in the initial stages of diligence. Pent-up demand and supply will resurface and companies that perform well during the economic downturn will be highly valued. Although there is a lull in activity now, it is highly likely that 2021 onward will be a very busy time. For now, it is time for both potential acquirers and sellers to reshape their businesses to enable them to be the best they can be when the downturn ends.