As 2021 was winding down, the US IT temporary staffing sector was on pace to exit it on a high note. SIA’s US Staffing Industry Pulse Survey covering October data — the most recent available as of this writing — showed a promising 15% year-over-year aggregate growth. Also encouraging was the 21% year-over-year growth for the segment at the median over the same period, matching an all-time high for the survey, only reached once before, in May 2021. SIA first started collecting this survey data in December 2013.

The pickup in business activity has spurred merger and acquisition interest in IT staffing. To the delight of staffing owners, we consistently hear anecdotal evidence of multiple expansions in the valuations being paid out, which is partially being aided by increased investment by private equity.

Yet the continued good times elicit questions around sustainability. Are we in a bubble of sorts for IT staffing? Is the sector in store for a rude awakening in 2022 and beyond? The first place one may look for answers are gross domestic progress forecasts. The Organization for Economic Cooperation and Development, for example, anticipates GDP growth to decelerate somewhat in the US, UK and across the Eurozone in 2022. Still, GDP growth is forecasted to remain comfortably above 3% year over year across these regions, a level that historically is quite conducive to staffing growth.

Economic factors will always play a crucial role in the direction of staffing growth, as it is fundamentally a cyclical industry. However, as evinced by resilience early during the pandemic, followed by a compelling resurgence in 2021, there are clear signals secular forces specific to the IT temporary staffing sector are quickly becoming more and more prominent. We identify three key factors behind this shift.

Essential, Universal Disruptor

The digital economy has been growing much faster than the overall economy for some time now. For example, in the US, the world’s largest market for IT staffing, the digital economy grew at an average rate of 6.8% from 2006 to 2018 compared to 1.7% for the total economy, according to the US Bureau of Economic Analysis. This divergence is only intensifying since the start of the pandemic, with worldwide spending on digital transformations now forecast to reach a scale of $2.8 trillion in 2025, more than double that of the spending level in 2020, according to IDC. This is just the tip of the iceberg as the global proliferation of connected devices, faster connectivity and profound advancements in AI technology serve as additional examples of why IT will increasingly serve as the catalyst in the disruption of entire industries.

War for Talent Intensifies

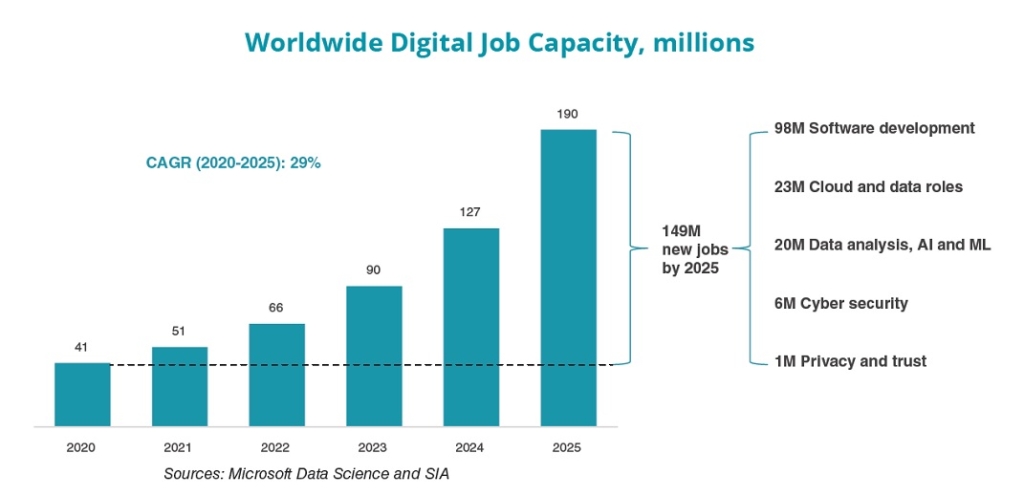

As investment into digital technology soars, the requisite digital skills will become increasingly paramount. As shown in the accompanying chart, Microsoft Data Science leveraging LinkedIn data predicts the capacity for digital jobs to expand by 149 million new jobs from 2020 to 2025, leading to a stunning 29% compound annual growth rate worldwide over the period. Software development accounts for two-thirds of the forecasted increase in digital job capacity over the five-year span.

The value proposition of IT staffing will become even more accentuated as the supply of digital skills will increasingly be unable to keep pace with demand. IDC predicts digital-related IT skill shortages will affect 90% of organizations by 2025, while a study by Korn Ferry forecasts a global talent shortage in the technology sector to reach a scale of 4.3 million workers by 2030. Even today, trend data from SIA’s US Staffing Industry Pulse Surveys reflects a severe supply and demand imbalance, with recruiting difficulty reported by IT staffing firms recently reaching record highs.

New Workforce Paradigms

Yet another forceful secular shift supporting continued growth in IT staffing is the paradigm of IT work itself. With supply constraints and the consequent salary inflation of IT workers, those seeking IT talent will have no choice but to adapt to more efficient models focused more on outcomes rather than headcount.

The IT workforce of tomorrow will become increasingly contingent, specialized, distributed and remote. This becomes especially intuitive when we examine where IT workers reside. SIA estimates 82% of worldwide IT temporary staffing revenue in 2020 was derived from the Americas and EMEA regions, yet only about half (52%) of the world’s software developers live within these regions, according to IDC. Clearly, APAC will play a larger role in helping these regions meet IT talent demands in the years ahead.

More Than a Strong Hand

The three factors outlined above provide a backdrop that positions IT temporary staffing well for sustained growth, perhaps above normalized rates seen in recent decades. However, a bright outlook alone is not enough for staffing firms to excel. The right mix of growth strategies must be set in place, and execution, of course, always proves critical.

At the individual firm level, opportunities abound to gain market share amid this radical transformation in both tech and talent. For further reading and an in-depth analysis of where we view the most attractive IT staffing growth opportunities, download our recent “IT Staffing: Growth Opportunities in the New World” report, which explores growth strategies in this new environment across a wide range of lenses, including technology areas, industry verticals, occupations, geographies, programming languages and specialization around specific software vendors.