The modern contingent workforce has been shaped by technologies that increase efficiency and compliance while

decreasing costs for firms throughout the talent sourcing process. SIA refers to this group of technologies as “talent acquisition technology.” Already a quickly growing slice of the workforce solutions ecosystem, talent acquisition technology has received added interest since the pandemic began, and investment in related technologies is only expected to continue.

In the “US Staffing Industry Pulse Survey Report: January 2022 Special Edition Update,” we asked firms to share how they were spending on talent acquisition technology. Classifications were based on our “Workforce Solutions Ecosystem: 2021 Update” report.

More specifically, in the Pulse Survey we referred to the following categories of talent acquisition technology:

- Online job advertising (job boards, social media and job advertising tools);

- Sourcing automation (sourcing process automation platforms, matching technology, people aggregation);

- Candidate engagement technology (texting/email platforms, recruitment chatbots);

- Candidate processing technology (ATS, VMS, freelancer curation, direct sourcing); and

- Candidate verification and assessment (background verification, skills testing, interviewing platforms).

Spending Across Categories

We asked participants to break down their 2021 talent acquisition technology spending across the various categories. We also asked firms to look ahead to determine whether they expected their spending per internal employee on talent acquisition technology to decrease, increase, or stay the same.

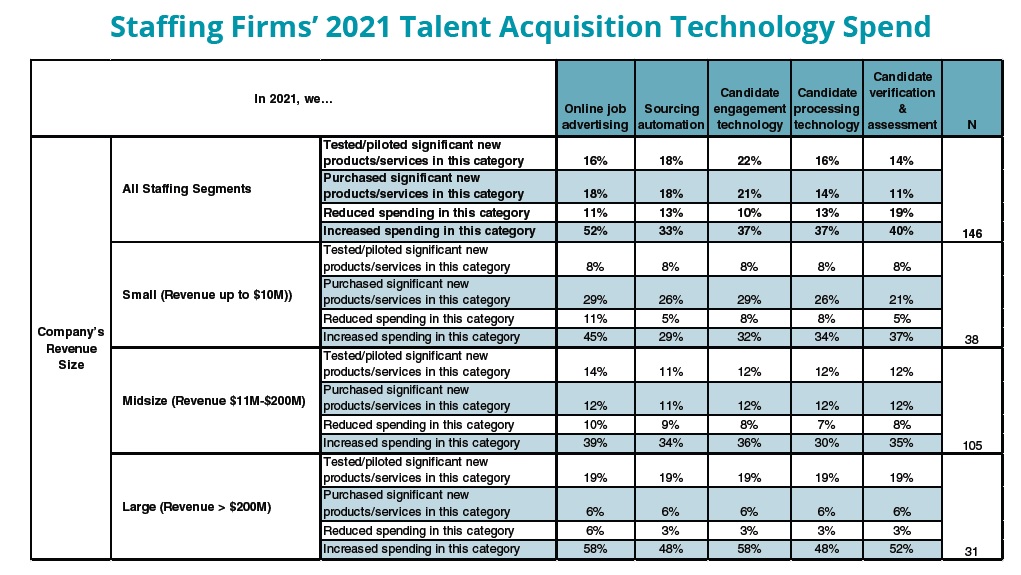

Overall, the talent acquisition technology category that respondents spent the most on in 2021 was online job advertising (52% increased spending). An additional 18% purchased significant new products/services, and 16% tested/piloted significant new products in this category.

For more about online job advertising, see the “Online Job Advertising Market” report. This shows that while staffing revenue was down by 11% in 2020, the online job advertising market grew by 1% in 2020. Online classified, job board, and job aggregator revenue was down 3% to 5% in 2020, but social media revenue was up 17%. As for 2021, examples of companies that reported strong quarterly growth during the year can be seen across the online job advertising spectrum: job boards (Dice), aggregators (ZipRecruiter), social media sites (LinkedIn) and community sites (Glassdoor).

Moving beyond online job advertising, 40% of firms increased spending on candidate verification and assessment in 2021, 37% on candidate engagement technology, 37% on candidate processing technology, and 33% on sourcing automation.

Large companies increased spending significantly more than midsize and small companies across all categories. Fiftyeight percent of large companies increased spending on online advertising, and 58% on candidate engagement and technology. Compare that to the top two at small companies (45% increased spending on online advertising and 37% on candidate verification and assessment) and midsize companies (39% online job advertising, 36% candidate engagement technology). Large companies by nature have more resources to put towards such increased spending, so this result is not unexpected.

However, small companies took the plunge and purchased significant new products/services at a higher rate across all categories (29% on online job advertising and 29% on candidate engagement technology), compared to 11% to 12% across categories for midsize companies and only 6% for each category at large companies.

Commercial staffing companies (office/clerical and industrial, with increasing spending figures ranging from 42% to 75%) increased spending to a greater extent than did IT staffing firms (26% to 34%) and per diem staffing companies (22% across all categories).

2022 Plans

Now that we’ve got a pretty good idea of how companies spent in 2021, let’s take a look at planned expenditures in 2022.

Seventy-one percent of overall respondents noted that their firm planned to increase talent acquisition technology spending in 2022, while only 2% noted a planned decrease in expenditure. This expectation is consistent across company size. However, by primary skill segment, we see an interesting dichotomy: Among the five major segments shown, IT has the lowest expected increase in spending per employee (59%). This could be due perhaps to IT staffing companies already having higher use of such technologies in place.

At the other end of the spectrum, travel nursing staffing companies reported the highest expected increase in spending, an impressive 88%. This is undoubtedly related to the staggering growth that travel nursing companies have recorded since the beginning of the pandemic (for reference, the travel nursing segment reported 85% or higher median year-over-year growth in every single Pulse Survey in 2021, breaking the 100% barrier four times).

Whereas IT staffing companies are relatively equipped for the growth expected in that segment in 2022 after years of outperformance, travel nursing staffing companies are making active technology investments to bring their systems up to speed with the volume that has seen an unexpectedly meteoric rise only in the last year or so.

Investor Interest

If you take a look at SIA’s “Staffing and Workforce Solutions Mergers & Acquisitions” tool, you’ll see that talent acquisition technology acquisitions in 2021 reached the highest mark since we started tracking in 2014. Not only are staffing companies testing out, investing in and purchasing talent acquisition technology products, but they are increasingly keeping an eye open for opportunities to outright buy provider companies. Spending on talent acquisition technology will continue to be essential in bringing staffing systems up to speed with the modern work landscape as it evolves amidst and eventually moves beyond Covid.