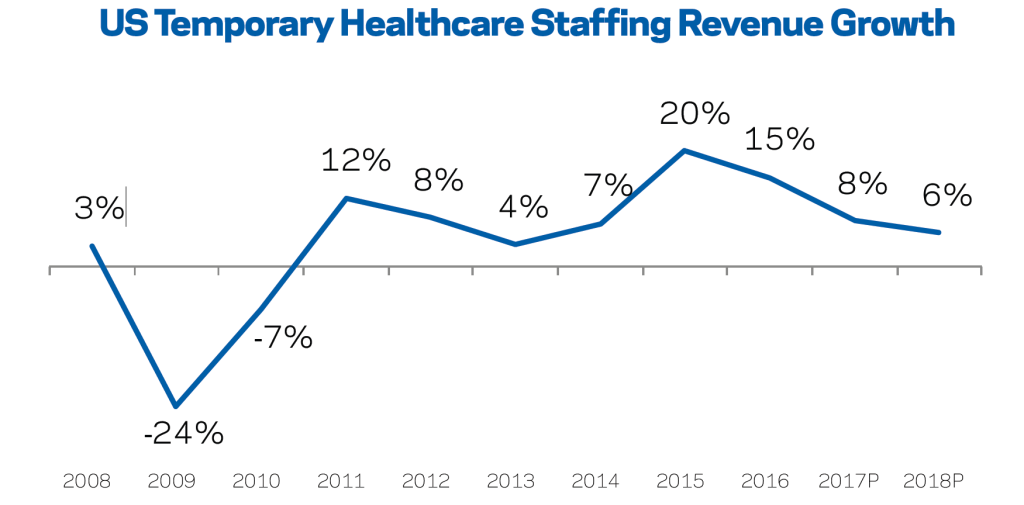

Believe it or not, it’s been more than seven years since the passage of the Patient Protection and Affordable Care Act, known as the ACA, and after a slow start, it’s been quite a ride for healthcare staffing. In 2015 and 2016, the healthcare staffing market grew by double digits as an influx of newly insured spurred patient volumes, driving demand for healthcare labor against a limited supply. Now that the influx of newly insured has mostly leveled off, what does the future hold for healthcare staffing?

Given the apparent surrender of ACA repeal, the future will not see 20 million people losing health insurance — nor the stark drop in demand for staffing that would cause. Though dodging such a worst-case scenario might be cause for celebration, the market is not without challenges. One headwind (which had been in place before ACA implementation but became less noticeable during the ACA boom) that has moved back to the fore is the long-term decline in hospital admissions, primarily due to greater pressure from payers to limit costs as well as price sensitivity on the part of individuals as they take on more cost sharing.

Several of the largest publicly traded hospital companies reported softer patient volumes in the first half of this year. And in response to softer volume, cost management was a major topic on several Q2 earnings calls. This was no doubt felt by their staffing suppliers. After growing 15% last year, we expect growth in the healthcare staffing market to decelerate to 8% this year, and then to 6% next year.

That said, while 6% growth is a slowdown from the ACA boom, it still represents solid performance. The reason we continue to project decent growth in the market through 2018 is that, despite the headwinds, there are several silver linings. First, hospitals have suggested an inflection point in these weaker trends, and consequently some healthcare staffing firms have noted a recent pickup in orders. Second, continued employment growth will yield more patients with (higher-paying) commercial coverage. Third, we view the likelihood of a recession before 2019 to be low. And finally, there is still a talent shortage.

For evidence of the talent shortage in healthcare, one need look no further than the unemployment rate, which was 1.4% for registered nurses in the second quarter of this year. This occupation has an extremely low unemployment rate, even after the number of candidates taking the NCLEX (entrance exam for nursing) for the first time has more than doubled in the last 15 years.

Even though demand has leveled off, supply has still not caught up, despite the increase in nursing school graduates. Moreover, talent shortages are not limited to nursing. Some occupational groups — such as physicians, physical therapists and occupational therapists — have an unemployment rate below 1%.

In addition to projecting revenue growth for the entire healthcare segment of the US temporary staffing market, we also break healthcare staffing into four subsegments (travel nurse, per diem nurse, locum tenens, and allied health staffing), and estimate and project the growth of each.

Travel nurse. No subsegment benefited more from the influx of newly insured than travel nurse, with estimated revenue growth of 40% and 25% in 2015 and 2016, respectively. We project a deceleration of growth to 10% for 2017 and 7% in 2018.

Per diem. Per diem nurse staffing did not benefit as much as travel business during that time, as many clients were desperate for nurses and eager to lock in longer-term assignments. Now that the effect of the newly insured has leveled off and patient volumes are softer, clients are more open to shorter assignments and per diem staffing is losing less share. After growing 7% in 2016, by our estimates, we project per diem nurse staffing to grow 6% in 2017 and 5% in 2018.

Locum tenens. Another area to benefit from rising demand in 2015 and 2016 was locum tenens, the staffing of physicians and advanced practitioners. Overall, locum tenens grew 17% in 2015 and 12% in 2016. Some locum firms were reporting growth in all specialties during this time, as even staffing of anesthesiologists and radiologists, laggards in locum for several years, had kind of bottomed out.

Now, however, the hot trends in the hospitalist specialty have cooled, as many hospitals have come to depend more on advanced practitioners for such a role as one way to manage costs. The hospitalist specialty had grown to such an extent that it had become the largest in the locum market. Locum businesses now finding themselves weighted heavily in that specialty are finding it challenging to grow robustly. We project growth in the locum market to decelerate to 6% this year and then to 4% in 2018.

Allied. The allied category consists of all healthcare occupations other than nurses and those in locum, with physical and occupational therapists and their assistants representing about half of the allied market. Results in our recent survey of allied health staffing firms indicate a wide variety in performance among firms even within each occupation, but generally show PT staffing growing and OT staffing declining from the first half of 2016 to the first half of 2017. Demand appears strong for medical technologists. Overall, we project growth in allied health staffing to decelerate from 15% last year to 8% this year and then to 6% in 2018.

As the demand driven from ACA has leveled off, opportunities remain, but the rising tide is no longer lifting all boats and staffing firms will increasingly need to choose the right markets and differentiate to continue to grow.