“Lead, follow or get out of the way.” This phrase applies in all walks of life. When running a staffing business, the art is determining the best course of action based on your firm’s unique strengths and capabilities.

In its Staffing Trends 2024 report, SIA identified seven trends within the workforce solutions ecosystem that can severely impact your business this year. Here’s a high-level look.

The tech stack. Staffing firms are racing to gain a competitive advantage from the vast array of technologies available to help them acquire talent. SIA’s interactive Directory of Suppliers to Staffing Firms has an ever-expanding list of 900-plus tech vendors specializing in everything from analytics and benchmarking to staffing platform-as-a-service (SPaaS).

According to SIA’s 2023 North American Staffing Company Survey report, software automation tools, software integration, workforce analytics, back-office software, social media screening and recruitment chatbots are already well integrated in the tech stack, and staffing firms have plans to invest even more in these areas.

Generative AI. Last year saw a breakthrough regarding public interest in, and the commercial application of, generative AI. It is not surprising that the rapid adoption and evolution of these tools have thrown business executives into a state of panic and confusion. Whole new ways of doing business are within grasp. Still, uncertainty remains regarding risk and speed of execution. Either act now to try to gain an early-mover advantage, or wait until more capable and less expensive technology emerges.

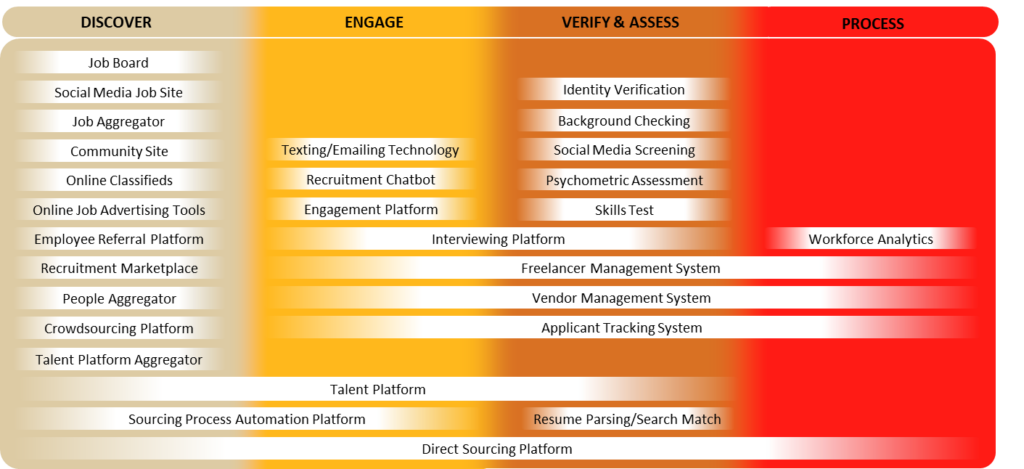

Emergence of multi-platforms. SIA categorizes the talent acquisition technology ecosystem across four activities: discovering, engaging, verifying and assessing, and processing talent. Within this structure, we classify 28 different types of technology. Currently, no dominant multi-platform operates across the whole range of employment-related activities, but it would not be surprising to see one or more begin to emerge. SIA’s Venture Capital Activity in the Workforce Solutions Ecosystem report identified almost $60 billion invested across the ecosystem between the first quarter of 2008 and the second quarter of last year, of which over 80% went toward HR tech, B2B platforms and other talent acquisition technology.

Limp economic backdrop. The US economy proved to be more robust in 2023 than was originally predicted, and the consensus now seems to be that the country is heading for a soft landing. However, the global economic backdrop to 2024 is decidedly lackluster. While a global recession may be less likely than it appeared 12 months ago, the International Monetary Fund forecasts that gross domestic product growth in advanced economies is set to slow to 1.4% this year from 1.5% in 2023.

According to ManpowerGroup’s 2024 Global Talent Shortage report, 75% of employers globally reported difficulty finding the talent they need, with the biggest impacts being felt in Japan. While this is lower than the peak finding of 77% in 2023, it remains surprisingly high given the softer economic environment.

Vote fest. The other issue that can have a profound effect on the operations of staffing firms is the political background; in this respect, 2024 is a remarkable year indeed. There has never been a year with so many important elections scheduled. More than two billion people will head to the polls globally, including in the US, UK, India, Mexico, South Africa and the European Union.

In its Chief Risk Officers Outlook 2023, the World Economic Forum found that continuing volatility in geopolitical and geoeconomic relations between major economies is the biggest concern for chief risk officers in the public and private sectors. Worryingly, most survey respondents within the report anticipated “upheavals at a global scale.”

ESG moving up the corporate agenda. Over the past few years, environmental, social and governance (ESG) issues have moved up the corporate agenda, perhaps due to increased awareness of sustainability issues and better corporate practices, or a reaction to increasing regulatory imposition.

Whatever the cause, ESG is now a concern of private fund providers from private equity to debt and beyond. Private companies should, at the very least, have a prepared ESG narrative so as not to exclude themselves from wider funding opportunities. The amount of lender and investor capital tied to ESG metrics continues to grow. Green lending can present new opportunities, lowering the cost of capital when borrowers can show a financial commitment to ESG metrics. An increasing number of companies are signatories to the Principles for Responsible Investment (PRI), which requires a specific commitment to goals and reporting.

The outsiders. In the past, there have been numerous examples of companies outside the workforce solutions ecosystem entering the market either by acquiring or launching new products and services. Some interlopers have stayed and prospered (e.g., Microsoft via LinkedIn), while others have receded and gone home (e.g., Meta via Facebook Jobs and Google via Kormo Jobs).

X (formerly Twitter) is the latest of these entrants to the world of recruitment. The X Hiring beta was launched in August 2023 following many rumors and its May 2023 acquisition of Laskie, a job-matching startup. (The CEO of Laskie, Chris Bakke, was subsequently appointed to head X hiring.)

Executives operating in our ecosystem are always wary of such intrusions, not least because they tend to come from powerful tech brands. The potential for a new market entrant to heavily disrupt or disintermediate the recruitment market remains a risk, especially in a world where technology is evolving quickly.