Innovation is flourishing throughout the workforce solutions ecosystem as new entrants seek to disrupt conventional business models. Perhaps nowhere is this more evident than the wave of new “unicorns” permeating the landscape. A unicorn, of course, is not just a pretty horse with a horn; it’s a term used to refer to startups that have achieved or surpassed the $1 billion valuation milestone.

SIA recently analyzed trends in the occurrences of such unicorns within the workforce solutions ecosystem, and the findings were startling. We discovered 72 unicorns across the globe within our ecosystem, representing more than 6% of unicorns across all sectors worldwide. Collectively, workforce solutions unicorns are valued at an impressive $196.2 billion.

Coming-Out Party

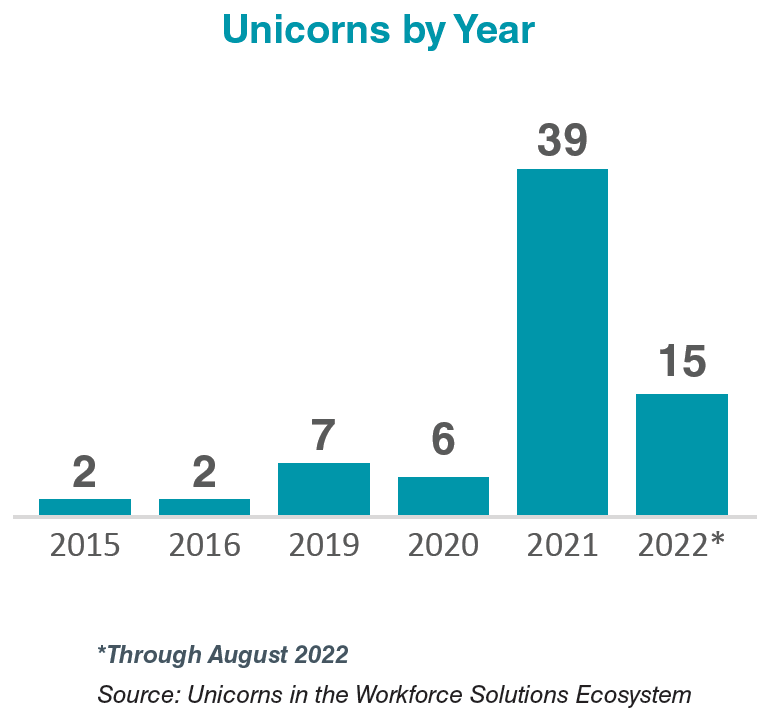

Prior to the pandemic, it was rarified air for workforce solutions startups to cross the $1 billion valuation threshold. From 2015 to 2020, the annual average of startups achieving unicorn status was four. However, 2021 was a coming-out party for investors into the ecosystem as the pandemic structurally changed the world of work — or at least accelerated changes that were already underway — and exposed immense long-term growth opportunities. This resulted in a staggering 39 startups reaching unicorn status last year alone, a more than sixfold increase from the six in 2020.

Even with a softening global economic outlook as recession fears loom throughout many regions of the world, investment activity in workforce solutions startups has continued at levels unseen prior to the pandemic. As shown in the accompanying chart, through August 2022, 15 startups have already become billion-dollar companies this year.

The pandemic not only stimulated activity from experienced investors familiar with the workforce solutions landscape but has also ushered in a throng of new investors. In total, SIA identified a whopping 296 venture capital firms that have infused more than $27 billion into these 72 unicorns. Consistent with the broader venture capital industry, most activity is derived from US-based investors.

Specifically, 69% of venture firms that have invested in this esteemed group are headquartered in the US. The next closest country is the UK with 6%. New York-based Tiger Global leads all investors with a band of 15 workforce solutions unicorn portfolio companies.

Workforce solutions ecosystem unicorns generally start with a modest level of funding. For instance, among this group, seed financing rounds were $2.5 million at the median, and series A rounds have a median raise of about $10 million.

Diversity in Sector Interest

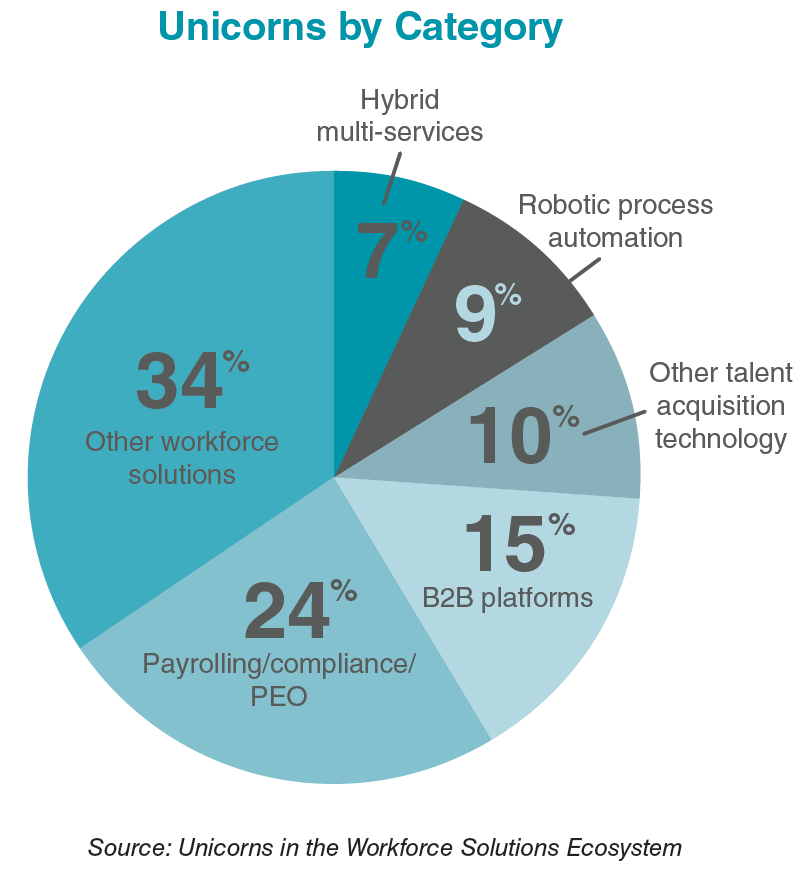

The report segments unicorns operating in our ecosystem into six major categories, including a hybrid category where a company operates across multiple segments. The presence of these “hybrid multi-service” (7%) companies is an interesting feature of the investment environment, perhaps serving as a harbinger of future convergences across categories. Impressive is the diversity of unicorns across categories. No single segment dominates investor attention, with the most found in “other workforce solutions” at 34%.

Deel, included within the payrolling/compliance/PEO category (24%), has the highest valuation of all workforce solutions unicorns at $12.0 billion, making it one of only three decacorns across the landscape (valuation exceeding $10 billion). Payrolling/compliance/ PEO has garnered heightened investor interest with surging acceptance and openness to remote work arrangements.

Some of the fastest-growing segments in the ecosystem are B2B platforms (15%). These include talent platforms (freelance marketplaces), staffing platforms and work services platforms. Though excluded from our analysis, we also identified 20 B2C platform unicorns. Food and goods delivery models factor most prominently here.

Pace of Innovation to Accelerate

Pace of Innovation to Accelerate

Some believe that the spike in the volume of unicorns since last year is a sign of a financial bubble. Indeed, a slowing global economy, attributed in part to soaring inflation, is dampening the overall pace of venture funding as rising interest rates make access to capital increasingly challenging.

However, even if uncertainty around macroeconomic headwinds results in fewer newly established unicorns in the near term, some aspects remain crystal clear. An unprecedented level of investment has been injected into this ecosystem with nearly $200 billion in venture funding into these 72 unicorns alone. About three-quarters of this capital has been deployed only just since the start of last year, meaning its impact has only just started to be felt. The cash infusion into R&D departments should accelerate the already rapid pace of innovation we see today.

Further, as more investors become involved in this dynamic and diverse landscape and see the opportunities ahead, promising startups will have larger audiences to pitch ideas to than in years past. Of course, raising money alone does not necessarily equate to innovation. As billionaire Peter Thiel, co-founder of PayPal, Palantir and the Founders Fund, famously said, “Creating value isn’t enough — you also need to capture some of the value you create.”