If staffing firms thought 2023 was challenging, 2024 won’t bring much respite.

In particular, there are two very thorny issues to contend with over the next 12 months, according to SIA’s new Staffing Trends report: The state of the economy and political uncertainty.

While a global recession seems less likely than many expected last year, GDP growth in advanced economies is set to slow to 1.2% from 1.5% in 2023. And despite some bright spots, such as the US economy’s expected soft landing, the global economy is expected to rack up the slowest half-decade of GDP growth in 30 years, according to the World Bank.

Employment figures are reflecting the uncertain economic environment. There are now more unemployed than job openings in all major economies other than the US. Yet skill mismatches are preventing the unemployed from finding work, as well as preventing staffing firms from filling vacancies.

Three-quarters of employers globally reported difficulty finding talent, according to a ManpowerGroup report. This is lower than 2023’s peak finding of 77%, but remains surprisingly high.

And while global staffing market revenue is expected to grow 4% in 2024, according to SIA staffing market forecasts, this modest improvement masks weakness in many European staffing markets. If we strip out inflation (forecast to be 3.9% globally), our estimate implies there is little structural growth to be found in the staffing industry this year. Price increases will likely drive whatever revenue growth there is.

Political Instability to Weigh

Political Instability to Weigh

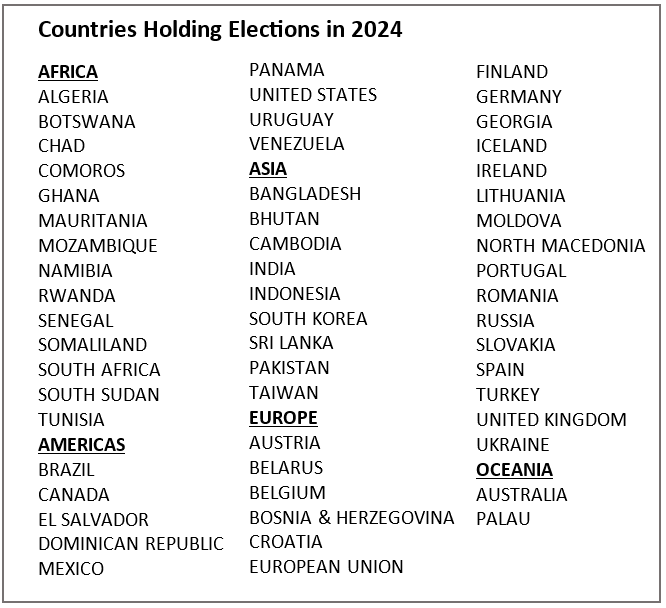

The global political environment will also influence staffing firm operations in coming months. Can you think of another year with so many important elections scheduled? More than two billion people are due to head to the polls in places including the US, UK, India, Mexico, South Africa and the European Union.

The impact of these elections will be profound given they represent an outsized chunk of global GDP; staffing executives hoping for a period of geopolitical calm are likely to get exactly the opposite.

In what is expected to be a highly contentious and turbulent election, Americans head to the polls in November to choose the next US president.

India’s election, between April and May 2024, will be the world’s largest: More than 900 million people are registered to vote.

And European elections are scheduled for June with more than 400 million voters electing 720 members of the European Parliament across 27 member countries.

While some elections seem to be a foregone conclusion, such as the Russian presidential election in March, there will undoubtedly be some surprises. Pundits are unable to predict results in some volatile countries such as Pakistan (population 231 million).

As elections become increasingly antagonistic, the same could be said for international economic relations. Conflicts in Ukraine as well as Israel, global warming, higher business costs, trade restrictions and market instability all weigh on business operations.

Volatility in geopolitical and geoeconomic relations between major economies is the biggest concern for chief risk officers in the public and private sectors, according to a World Economic Forum report. Worryingly, most survey respondents anticipated “upheavals at a global scale”.

If all this paints a negative outlook for the next 12 months, there are still reasons for optimism. With the right strategy in the right region and in the right segment, staffing firms can identify pockets of opportunity. For those able to harness AI and other technological developments to drive growth, there is growing acceptance of alternative work forms, endemic skills shortages, and radical business transformation. Staffing firms are at their very best in supporting clients through uncertain business environments — regardless of whatever economists or politicians throw their way.